Engineering firm Weir (WEIR) has scrapped its 2019 final dividend as it revealed that orders for oil and gas projects plunged 34% in the first three months of 2020 following the collapse in oil prices.

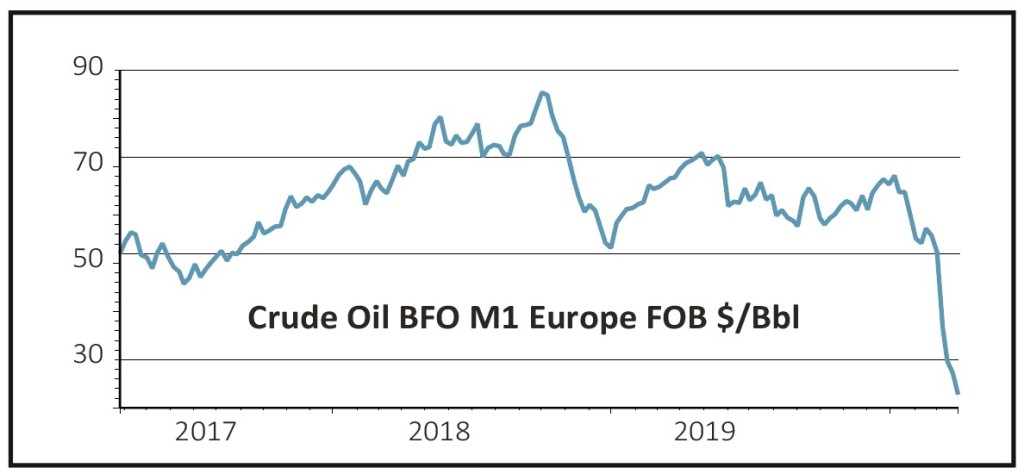

Oil futures have plunged to multi-year lows thanks to a huge drop-off in demand as the coronavirus pandemic slashed economic activity. A vicious price war between two of the world’s largest producers, Saudi Arabia and Russia, has added to the downward pull on prices.

Last year, 30% of Weir’s revenue came from oil and gas projects.

The company said that aftermarket income from mining projects was providing some resilience, which comprised 80% of its total orders. However, this was not enough to prop-up overall orders which fell 13% during the quarter.

TIN HAT RESPONSE

Weir said it was reeling back capital expenditure and suspending its annual bonus for management to help conserve cash, but the company believes worse is still to come.

‘After a resilient first quarter, we expect Covid-19 to have a greater impact in the second quarter,’ Weir said.

‘Given the uncertain environment no specific guidance is provided for the remainder of the year, although we will update as and when visibility improves.’

Weir also said that it was currently undertaking a refinancing of its $950m revolving credit facility, as part of a normal schedule. ‘These discussions are ongoing and are expected to conclude during the second quarter,’ the company said.

MEAGRE RETURNS FOR SHAREHOLDERS

In February, Weir said it planned to pay a final 2019 dividend of 30.45p per share. That payout has now been pulled leaving shareholders with just the first half 16.5p income payment to show for the year.

Also in the full year 2019 results in February, Weir revealed that it was considering its long-term options for its oil and gas business, with a sale seemingly likely. But those exit plans look doomed for the time being.

‘Given the current circumstances, we believe, in the short to near-term, it would be difficult to crystallise any value from the Oil & Gas disposal until the market backdrop has improved,’ said analyst at broker Shore Cap today.

‘Thus, we see the share price struggling to appreciate in the near-term.’

Weir shares remained virtually flat in thin trading on Tuesday, changing hands at 870p. The stock has fallen more than 37% since late February, when the scale of the pandemic started to become clear.