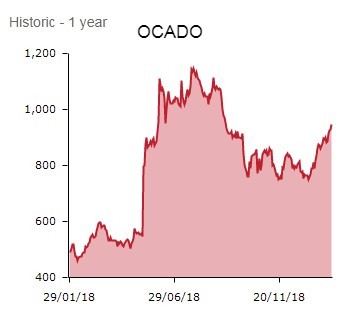

Shares in Ocado (OCDO) ripen up 3.7% to 981.4p on reports it has held secret talks with embattled Marks & Spencer (MKS) over the launch of a food delivery service. Marks & Spencer’s CEO Steve Rowe has thus far resisted an online food offer, but the bowed high street bellwether urgently needs to regain lost ground in the fast-evolving retail sector and come up with radical solutions to arrest its decline.

The rumoured tie-up could mark the end of Ocado’s long-running relationship with Waitrose, as a current supply deal between the pair ends in September 2020. It must be stressed neither Marks & Spencer or Ocado has yet confirmed the validity of this story, one with seismic implications for UK retail.

M&S TO JOIN ONLINE FOOD FIGHT?

According to weekend press reports, grocery delivery is on the menu as a key way for Marks & Spencer’s ruthless chairman Archie Norman to turn around the retail institution’s ailing fortunes.

Although Marks & Spencer has been trying out online food deliveries in areas such as North London since 2017, it has yet to put serious resources behind the full scale online grocery stores offered by rivals and still lacks a fully fledged food delivery service.

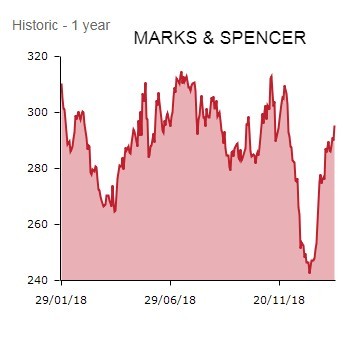

The Mail on Sunday suggests Marks & Spencer, marked up 1.8% to 295.3p on today’s market jackanory, might be interested in purchasing key distribution centres, delivery vans and lorries from Ocado, which has a long-run supply relationship with John Lewis Partnership-owned Waitrose. This supply deal gives Tim Steiner-steered Ocado the right to sell Waitrose goods and use the brand on its website and fleet of vans.

A tie-up with British retail stalwart M&S would probably result in Ocado dropping Waitrose as its key groceries supplier, since Ocado’s technology would be powering a rival food brand. Back in 2013, Waitrose was needled by Ocado’s signing of a contract with Morrisons (MRW) that enabled the Bradford-based supermarket to launch its own grocery home shopping service.

FROM ‘MARMITE’ TO RETAIL’S ‘MICROSOFT’

Chaired by former Marks & Spencer CEO Sir Stuart Rose, Ocado, long a ‘marmite’ stock among investors, has successfully transformed itself from a niche online grocer with a focus on the affluent south east of England, into an e-commerce technology platform, concentrating on selling its Ocado Smart Platform (OSP) service to retailers on the global stage.

For the uninitiated, the OSP service, based on proprietary software and algorithms as well as robotic warehouses, powers online grocery for a burgeoning band of international clients.

Deals have been struck with Casino in France, Sobeys in Canada, ICA in Sweden and perhaps most notably of all Kroger in the US, a transformative transaction that led brokerage Peel Hunt to label Ocado ‘The Microsoft of Retail’.

Russ Mould, investment director at AJ Bell, says 'the market seems to think Ocado would be the winner of a tie-up with Marks & Spencer judging by the respective share price reactions to speculation that the two companies are looking to strike a deal.

'Reports suggest Marks & Spencer is interested in buying some of Ocado’s distribution centres and delivery vehicles. In essence it would buy the part of the group currently powering Waitrose's deliveries.

'Such a move would be another tick in the box for Ocado which is adding relationships with supermarkets in several parts of the world. Its core focus is now selling technology expertise to the food retail sector rather than running physical delivery operations.

'Marks & Spencer needs to try every possible angle if it stands a chance of breathing new life into the company. Food has long been a crucial part of its attraction to customers so having a proper delivery service is a natural step forward.'