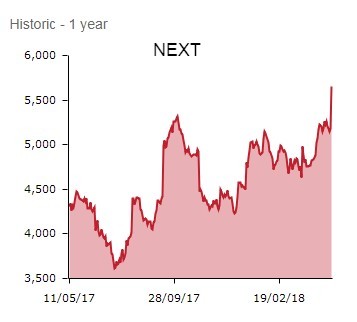

High street retailer Next (NXT) is back in fashion with investors after upgrading full year sales and profit guidance following a shoot-the-lights-out first quarter (Q1) sales performance.

Shares in the Leicester-headquartered high street bellwether skip 6.2% higher to £55.70 on news recent ‘unusually warm weather’ boosted sales. Yet it should be noted Q1 takings were always likely to look good given the poor quarter a year ago and management still doesn't think the stronger Q1 will be replicated across the rest of the year.

First quarter sales of NEXT branded stock grew by a better than expected 6% - around £40m ahead of management’s forecast - with the performance over the 14 weeks to 7 May boosted by the recent spell of warm weather.

This over-performance adds ‘around £12m’ to full year profit expectations and thus, CEO Simon Wolfson (pictured below) upgrades the year to January 2019 guidance given with March’s full year results.

Next raises its pre-tax profit guidance from £705m to £717m, full price sales growth of 2.2% now envisaged, up from previous guidance of 1%, though this still means a 1.3% profits decline is on the cards.

ONLINE - THE STAR PERFORMER

In today’s new issue of Shares Magazine, we outline the bull and bear cases for Next, a retailer recovering from a 2017 which was ‘the most challenging year we have faced for 25 years’, in the words of Wolfson.

Long-prized for its best-in-class retail disciplines and management team and a formidable record of returning excess cash, bears point to a large legacy physical store estate that drains capital and online growth that lags that of peers.

Yet drilling down into the Q1 numbers, it is clear the online business proved the star performer. While physical store sales fell 4.8%, online revenues surged 18.1% higher, driven by NEXT branded stock and third party brands together with international growth.

CAUTIOUS OPTIMISM

Next’s Q1 sales were however flattered by last year’s soft comparatives and Wolfson & co don’t expect sales for the rest of the year to be as strong.

Remember, the recent mini heatwave will have pulled forward spending on summer ranges with potential to subdue sales in the coming quarters.

In other reassuring news, Wolfson insists Next’s cash flow remains strong and the company still expects to generate circa £300m of surplus cash this year. This is being returned to shareholders via earnings per share enhancing share buybacks.

DEFYING THE CRITICS

Russ Mould, investment director at AJ Bell, comments:

‘Next has defied its critics by reporting a very strong first quarter trading update. The company now makes more profit from its online operations than its physical stores, so it is particularly pleasing to see the online arm soaring ahead with 18.1% sales growth in the 14 week period.

‘Despite its best-in-class reputation, Next has recently been making some basic adjustments to its business model which perhaps should have been done a long time ago.

‘For example, 10% of stock that customers attempt to order online has historically been sold out, and a further 20% not available for immediate delivery.

‘Many people may wonder why it is still bothering to spruce up its stores when online is clearly the stronger business. In reality the stores play an important role for click-and-collect and keeping Next’s brand in front of shoppers.

‘It is also worth noting that landlords have recently been helping with some store refurbishment costs, illustrating how Next’s presence is considered to be a magnet for consumers to visit shopping centres.'