- Full-price sales top expectations

- Full-year targets raised again

- Analyst sees online sales revival

For investors in retail group Next (NXT), quarterly earnings updates must be a familiar routine with the firm beating estimates and lifting its outlook, and today’s third-quarter trading update is no different.

Nevertheless, given the tough environment for retailers due to the pressure on household finances, the news received a warm welcome with the shares popping 3.5% to £71.18 taking them to the top of the FTSE 100 leader board.

FASHIONABLY AHEAD OF FORECASTS

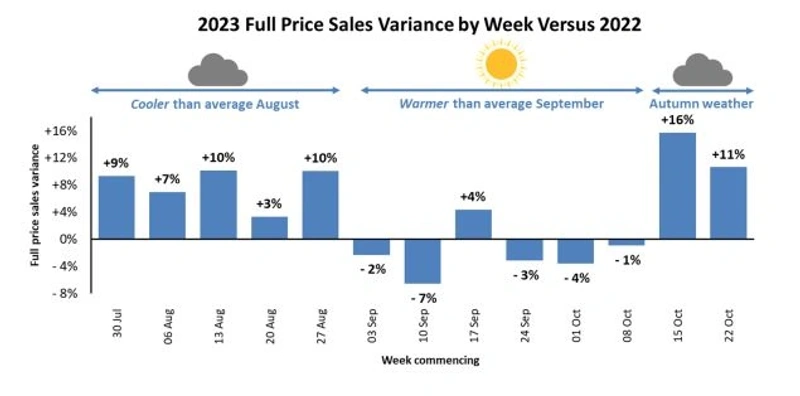

Full-price sales for the August to October period were 4% ahead of the same period last year, 2% or £23 million ahead of the firm’s target, led by strong online sales up 6.5% and higher interest income (Next includes finance income in its sales figures).

The company admits it got lucky with the weather, which was cooler than normal in August encouraging shoppers to add layers, and it is now forecasting full-price sales growth of 3.1% instead of 2.6% for the year to the end of January.

Pre-tax profit guidance also received a small nudge higher to £885 million against £875 million previously, and there will be a one-off gain of £110 million – which is excluded from the headline profit figure – due to the group's increased stake in fashion brand Reiss.

IS NEXT AHEAD OF THE TREND?

Shore Capital retail analyst Eleonora Dani picked up on the firm’s strong online performance: ‘Online sales remain a strong growth driver while the physical channel shows some softness. The focus on full-price sales as opposed to clearance events suggests a potential shift in consumer spending habits towards quality over quantity. Overall the third quarter performance bodes well for both the company and the retail sector at large, at least in the short term.’

This view seemed to be echoed by investors, with shares in high-street rival Marks & Spencer (MKS) rising 2.3% to 222p putting them in second place on the FTSE 100 leader board.

LEARN MORE ABOUT NEXT