Asset manager Octopus Investments has launched its inaugural Dividend Barometer to champion the ‘lesser-known dividend credentials’ of small and mid-cap income stocks.

NARROW FOCUS

The reason behind the move according to Octopus is that the ‘UK equity income conversation is focused [all too often] on a narrow set of large companies. This overlooks businesses outside the FTSE 100 with strong dividend cover and a track record of growing dividend distributions’.

The report will be an annual offering from Octopus’ Quoted Funds team in order to highlight the dividend credentials of lesser-known small and mid-cap income stocks.

Source: Octopus Investments

ATTRACTIVE RETURNS OUTSIDE FTSE 100

According to the report, there are more than 550 dividend paying companies across the entire UK equity market and many of these have attractive levels of earnings growth.

Performance in the FTSE 100 may have improved recently and is expected to deliver a dividend yield for the current year of a little over 3.9%.

Source: Octopus Investments

However, the FTSE 250 (ex-Investment Trusts) is expected to pay out a healthy 3.4%, and the FTSE Small Cap (ex-Investment Trusts) is expected to yield 3.8%.

DIVIDEND DIAMONDS

For the hungry income investor, the Barometer covers a few select ‘Dividend Diamonds’ which are a few small and mid-cap companies that have significant income potential.

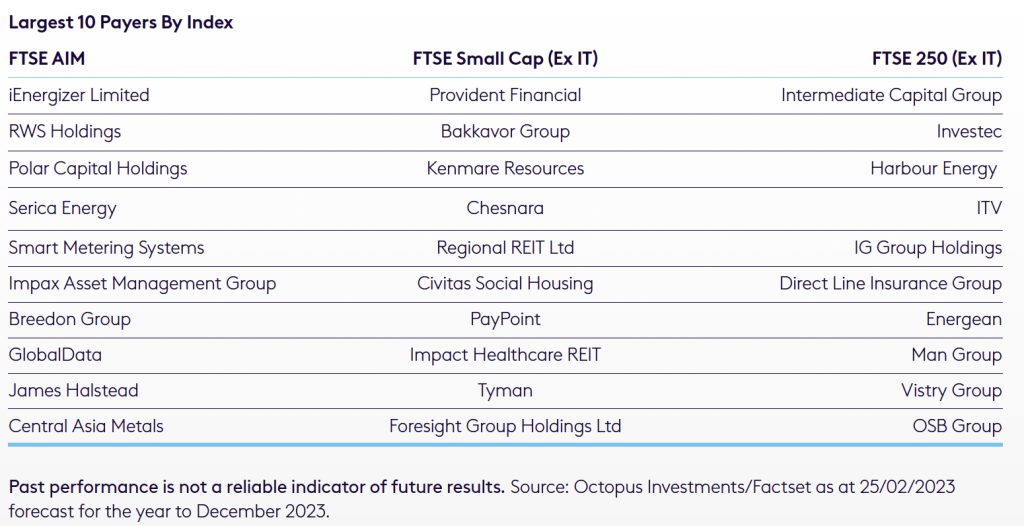

This quarter, the report identifies two stocks - global alternative asset manager Intermediate Capital (ICP) part of the FTSE 250. The group has seen growth in its ordinary dividend for 12 consecutive years.This adds up to a five-year dividend compound annual growth rate of almost 22%, with an expected dividend yield of 5.8% for fiscal year to March 2023.

The other ‘dividend diamond’ is international translation services specialist RWS Holdings (RWS) which is expected to be one of the largest cash dividend payers on AIM, following the record £41.9 million paid out in 2022, for the year to December 2023. This will mark 17 years of unbroken dividend progression, a 5-year dividend compound annual growth rate of 10.8%, and an expected dividend yield for the year to September 2023 of 3.5%.

Source: Octopus Investments

OTHER HIGHLIGHTS FROM THE REPORT

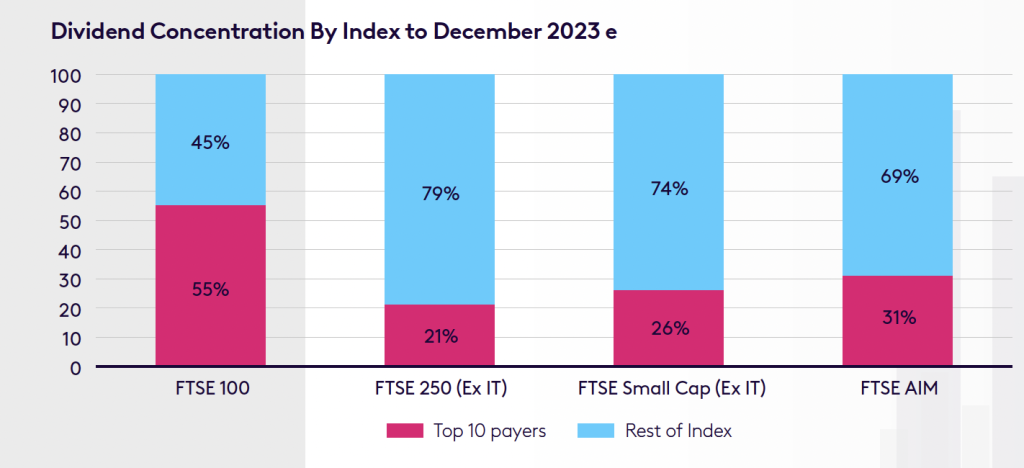

The report from the small cap and venture capital trust expert, also identifies the following: just 10 stocks are expected to generate 55% of total pay-outs in the FTSE 100, a significant concentration; FTSE AIM is the only index where payouts are expected to recover to pre-Covid levels in 2023 and the FTSE AIM total dividend payouts have increased by an impressive 64%, from around £770 million to almost £1.3 billion expected for 2023. This compares to FTSE 100 total dividend payouts increasing by only 17.3%.