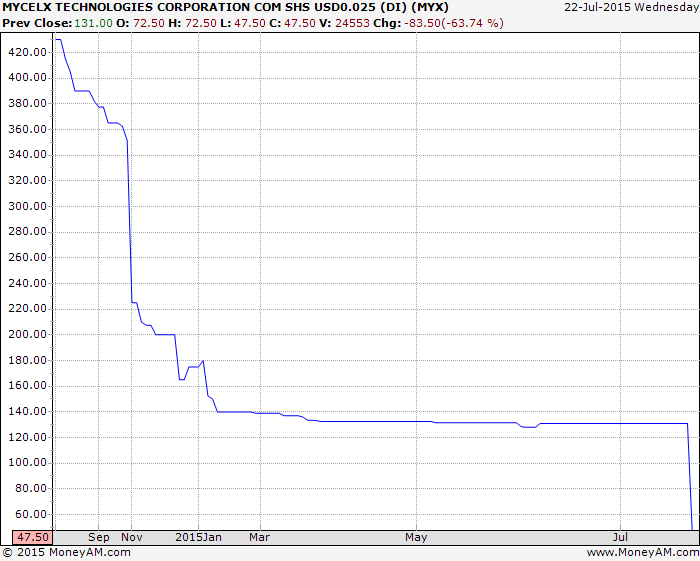

Oil services minnow Mycelx (MYX:AIM) is in free-fall - down 65.7% to 45p - as it warns challenging conditions in the sector will persist into the second half of the year and adds that a major project it hoped to win is not progressing.

Its experience shows that even good technology can struggle to gain traction in a conservative industry - particularly when spending is being pared back. The scale of today's fall also reflects the lack of liquidity in the stock.

Revenue guidance for the year as a whole is in the $15 million to $16.5 million range, which is up between 10% and 20% on 2014 but below the $23.6 million that had been pencilled in by analysts.

No guidance is given on profitability though previously consensus was forecasting pre-tax profits of just more than $1 million. Half-year results will be announced on 10 September.

The Gainesville, Georgia-headquartered firm has developed a patented technique for separating hydrocarbons from waste water. It uses a polymer to permanently clean water which has been dirtied by the oil industry, removing the oil and any other associated waste.

It sells both the external equipment which houses the MyCelx media, essentially filters immersed in its polymer, and the consumable filters themselves. All manufacturing is outsourced.