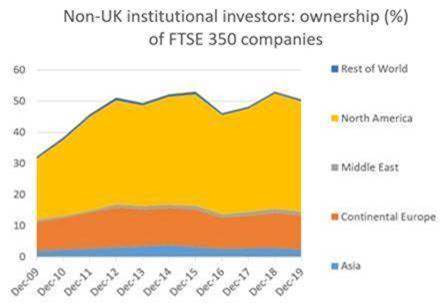

Investors living in North America, Europe and elsewhere own more than half of the UK’s biggest listed companies, after a dramatic surge of investment into the FTSE 350 in the wake of the EU referendum vote, according to a report.

Data from investor relations specialist Orient Capital, part of the Link Group, shows that 51% of shares in UK companies in the FTSE 100 and FTSE 250 indices are owned by funds and trusts operated by asset managers based overseas, led by North American investors.

UK BARGAIN HUNTING

Orient reveals that 35.9% of shares in UK companies in the FTSE 350 are owned by funds and trusts operated by North American companies, with passive fund managers such as Vanguard and BlackRock dominant.

‘Since the EU referendum, though many foreign investment managers shunned UK companies, there was a remarkable acceleration in interest from those in North America, who almost doubled their stakes in the market, from owning 19.8% to 35.9% at the end of May this year,’ the report states.

Source: Orient Capital

European institutions have an 11% stake of FTSE 350 companies, while those based in Asia and the Middle East own 2.3% and 1.2% respectively, as of May this year. UK institutions own 22.1%.

The balance is made up of retail investors, predominately from the UK.

PASSIVES BOOM

The data also shows the popularity of passive funds has soared, namely products offering investors access to a slice of the whole market at a low cost.

Source: Orient Capital

‘In investment terms, the tectonic plates are shifting beneath us and ownership of the UK market is being pulled across the Atlantic,’ says Jason Black, chief operating officer at Orient Capital.

‘Our data shows significant change in ownership of the UK’s biggest listed companies predominantly due to the growth of passive investing driven by the big three North American asset management houses; BlackRock, Vanguard and State Street, who together manage more than $17 trillion in assets.’

STOCK PICKERS STILL DOMINANT

But the UK market is still dominated by active managers, who own a majority (55.9%) of all FTSE 350 shares.

‘With all this money from passives now algorithmically rushing into the biggest stocks through market-weighted indices, some investors may wish to stick with active portfolio managers who continue to make potentially more subjective and nuanced investment decisions,’ said Orient’s Black.