It's becoming increasingly difficult to see how Ceramic Fuel Cells (CFU:AIM) has a long-term future. Even after posting a 43% jump in unit volumes the company itself admits that this is simply not good enough and won't keep the business going. The company has previously acknowledged that 'this level of sales will not sustain the business.'

Ceramic Fuel Cells makes small-scale power generators using fuel-cell technology that converts natural gas into heat and electricity for homes and small commercial buildings. It sold 71 of its BlueGEN units in last quarter to June, up from 15 a year ago, but that still only adds up to 210 unit sales for the entire year.

This generated £3.4 million of revenue, pretty paltry against the company's £14.6 million market value, and that's after today's 11.5% share price slump to 0.58p. The stock was worth 16p per share five year ago.

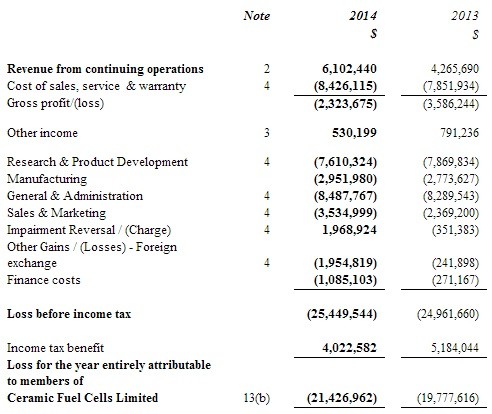

And no wonder, net losses continue to increase, up 8% last year to £11.8 million, or three and a half-times its sales. And that's after getting £2.2 million tax rebate.

The company hopes that cutting away at manufacturing, service and warranty costs will help. It will but not enough. Ceramic is still spending money like it's going out of fashion, £4.2 million last year on resaerch and development (R&D), £1.6 million on manufacturing, £1.94 million on sales and marketing, and a staggering near £4.7 million on general admin (see below).

Now wonder cash burn remains mind-boggling, chewing through £10 million last year. With just £2.9 million net cash left on the books another deeply discounted cash call looks inevitable, something Ceramic has had plenty of practise at.