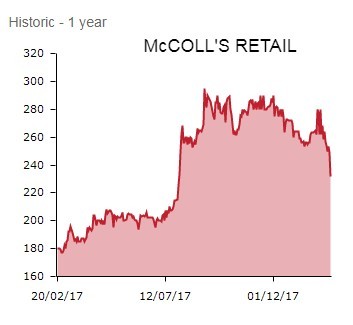

Shares in convenience stores operator McColl’s Retail (MCLS) have taken a beating after missing full-year profit expectations and reporting a weak start to the new financial year, falling 4.6% to 237.5p.

The company has warned about a continuation of supply distributions following the collapse of wholesaler Palmer & Harvey.

Group like-for-like sales have fallen by 2.2% in the first 11 weeks of the financial year.

Stores formerly supplied by Palmer & Harvey suffered a 3.6% like-for-like sales decline in the period. McColl’s has now moved its supply agreement to Morrisons (MRW).

HOW SEVERE WAS THE PROFIT MISS?

Stockbroker Numis had forecast £24.9m adjusted pre-tax profit for the year to 30 November 2017.

McColl’s has missed this estimate by £1.7m (or 6.8%), reporting £23.2m pre-tax profit after accounting for certain items.

On an unadjusted basis, pre-tax profit increased by 4.2% to £18.4m.

HOW IS MCCOLL’S FIXING THE PROBLEM?

McColl’s entered into a new short-term supply deal with Nisa on 4 December for stores affected by Palmer & Harvey’s demise. It also pulled forward the start of its new supply partnership with vertically integrated grocer Morrisons to supply these same stores with tobacco.

In January 2018 McColl’s launched a new Safeway branded range of around 400 products to 102 stores as part of a phased rollout of circa 25 stores per week and has ‘been pleased with early customer reaction’.

As chairman Angus Porter elaborates: ‘This decision, at a time when the convenience sector is rapidly evolving and experiencing a period of consolidation, aligns McColl’s with a strong partner.

‘It will allow us to provide a significantly enhanced fresh offer for customers through the launch of the Safeway brand, and access to better commercial terms whilst simplifying operations through sole supply.’

£1BN BARRIER BREACHED

McColl’s says its annual sales have now exceeded the £1bn barrier, reporting £1.13bn for the 2017 financial year.

Sales have been propelled by the acquisition and integration of 298 convenience stores from the Co-op.

McColl’s has also reported a 60 basis point improvement in gross margin to 25.7%, reflecting a higher mix of convenience stores (now 80% of the estate) and more alcohol and groceries in the sales mix.

‘Continuing this momentum, this year we will significantly enhance our customer offer as we transition supply in over 1,300 stores to Morrisons and exclusively launch hundreds of new Safeway branded products at McColl’s,’ says CEO Jonathan Miller.

‘We will also further invest and improve the quality of our estate by extending our successful convenience store refresh programme to 100 additional stores this year.’

TINY PROFIT MARGINS

AJ Bell Investment Director Russ Mould says the £1bn+ revenue shows the business has considerable scale. Yet he says it is only making tiny profit margins ‘which leaves very little breathing room if something goes wrong’.

He adds: ‘Net profit margins were a mere 1.25% in its 2017 financial year. McColl’s is effectively a volume game, trying to sell as many items as possible to customers. It has been trying to find new ways to entice people into its shops, such as having Post Office and Subway concessions.

‘A deal is also in place for Morrisons to supply fresh food and groceries to its stores. Yet competition remains fierce, particularly as Tesco (TSCO) will have greater buying power for its convenience stores assuming its takeover of Booker (BOK) is approved by shareholders.’