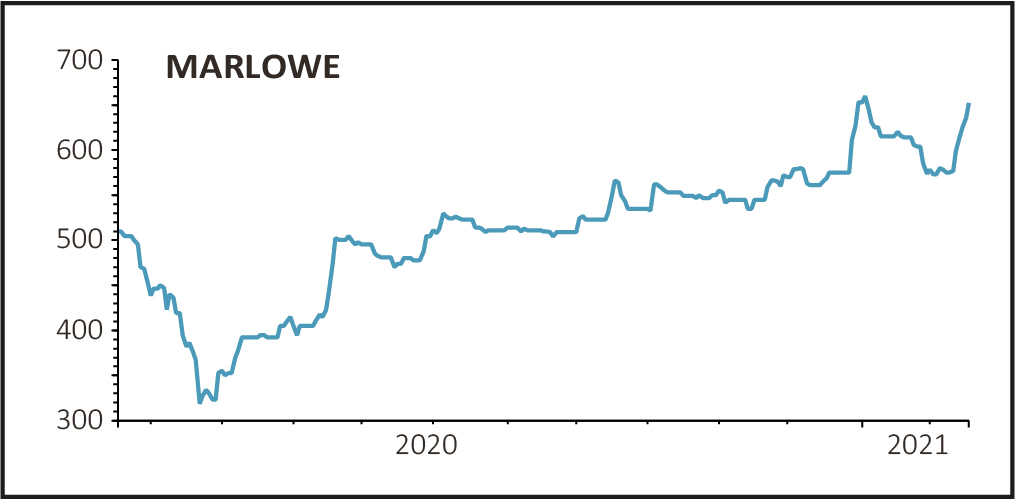

Shares in safety and compliance software firm Marlowe (MRL) continued their impressive recent run with a gain of 3.8% to 660p after the company raised its guidance for operating profits for the year ending in March and set itself an ambitious growth target.

Thanks to strong second-half trading, the group expects earnings before interest, taxes, depreciation and amortization (EBITDA) to be ‘at the top end of current market expectations’. Market forecasts range from £23.6 million to £26.3 million.

NEW TARGETS

Meanwhile, the firm launched its Capital Markets Day for investors, setting out some aggressive growth forecasts and a new divisional reporting structure.

The company’s new aim is to generate annual revenues of £500 million and EBITDA of £100 million over the next three years, thanks to organic top-line growth and acquisitions.

According to the company, its current run-rate revenue is £245 million and adjusted EBITDA is £37 million, so today’s forecasts aim to double the top line and treble profits by March 2024.

As part of its strategy, Marlowe is re-organising itself into two divisions, Governance, Risk and Compliance - which will provide Health & Safety, employment law/HR services and compliance - and Testing, Inspection and Certification, which will provide testing and inspection across fire, safety and security, water treatment and air hygiene.