Supermarket chain Tesco (TSCO) gets off the a strong start to the current year with first quarter sales beating market expectations. Britain’s largest grocer reports a like-for-like sales increase of 2.3% in the three months to 27 May, boosted by demand for fresh food. That’s after stripping out the impact of new stores. The news is welcomed by investors, although early morning gains become tempered, the share price 0.8% higher to 181.4p

Mining giant BHP Billiton (BLT) has named its successful packaging executive Ken MacKenzie as its next chairman. The former CEO of packaging group Amcor, will take on the job from September when Jac Nasser stands down. McKenzie faces a tough task, where he will have to tackle calls to dump its oil business and overhaul the board. According to reports, the appointment has been welcomed by activist shareholder Elliott Management, the shareholder that has been calling for a major overhaul of operations at BHP for several months.

Australian financial services firm Link Group and three buyout funds are reportedly putting the finishing touches to their rival offers for Capita's (CPI) asset management services arm. An expected deal worth up to £800m is expected to follow. Shares in the services outsourcing group nudge 6p, or about 0.5%, higher to £11.66.

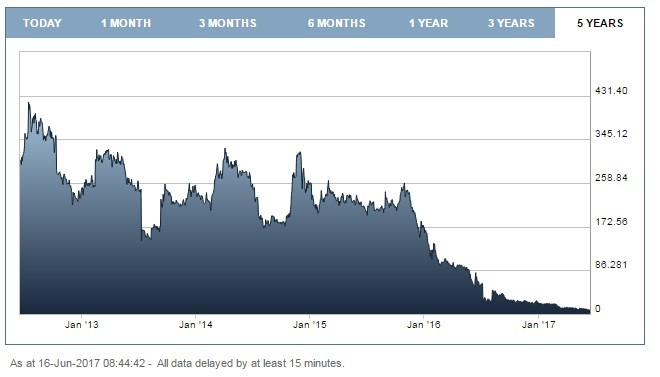

Cash-strapped satellites operator Avanti Communicaions (AVN:AIM) announced on Friday that New York-based global investment firm HPS will provide it with a new $100m three-year debt facility. Interestingly, the new borrowings will be struck at an interest rate of 7.5%, allowing Avanti to replace more expensive debt arrangements currently in place. Investors are over the moon, the share price soaring 46% in early trade on Friday to 11.75p, although that’s still a fraction of the company’s past valuations.

Shares in aero-engineer Rolls-Royce (RR.) nudge a little higher to 903p as the company sticks to full-year forecast guidance after a good start to the year.

Construction services business Amec Foster Wheeler (AMFW) rise 1% to 487.8p as the company clinches a new contract worth A$298m. The work is for the Gruyere gold project in Western Australia alongside its joint venture partner, Civmec Construction and Engineering.

Connectivity hardware designer Telit Communications (TCM:AIM) jumps nearly 5% to 323p as its bags its first US order for its Cat 6 automotive-grade connectivity module. ‘Besides high-speed, the module was designed with specific attention to cyber security requirements in order to support reliable and comprehensive use of over-the-air software update technology,’ says Telit CEO Oozi Cats. In-car connectivity is a big growth lever for automotive manufacturers.

Shares in tiny buying platform operator EU Supply (EUSP:AIM) rallies close on 14% to 16.5p after the company sealed a new framework deal with an existing customer. The new arrangement is worth €3.6m over three years and will include proving extra services.

US-based copper and gold digger Great Western Mining (GWMO:AIM) sees its share price tank on Friday as it goes cap in hand to shareholders for fresh funding. The company is raising £1.15m to pay for exploration work on its projects in Nevada. But the 26% discount on yesterday’s 1.7p close drags the share price 18% lower to 1.4p.