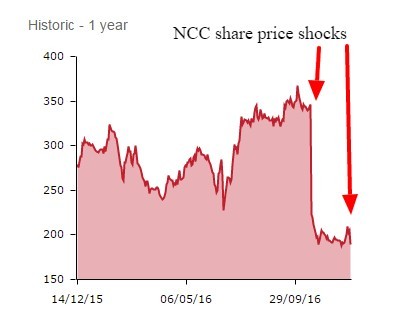

Cyber security company NCC (NCC) has had to come clean that its previous confidence on recovering a profit shortfall from losses and delays of several contracts in the core IT assurance division is too much of a stretch. The company admits that it will not now be able to make-up the gap which has become 'too significant to fill in the second half.' Shares suggested what looked like a missed opportunity to reset expectations after the initial shock alert in October. This latest blow sparks a 14% share price slump to 176.3p, which means the stock has halved in two months.

Rupert Murdoch's Twenty-First Century Fox aims to table a firm cash bid valuing British broadcaster Sky (SKY) at £10.75 per share as early as Wednesday for the 61% of the company it does not already own. That's according to several people thought to be close to the deal. Sky is currently trading at 979p.

Flooring specialist Carpetright (CPR) saw interim profits slump 42% in the 26 weeks to 29 October blaming unpredictable demand and the slump in the pound versus the euro. That drags the stock 7.5% lower to 185p.

Housebuilder Bellway (BWY) continues the largely upbeat trend across the UK sector, stating a 7% rise in reservations in the 18 weeks to 4 December. The company also expects housing completions for the year to the end of July 2017 to rise by 5%, news that is being welcomed by investors, marking the share price more than 3% higher at £24.68.

Oil services firm Hunting (HTG) remains positive on near-term trading now that its balance sheet has been shored-up but cautions over how much visibility it has regarding 2017. That drags modestly on the share price, down 1.7% at 620p.

Media group UBM (UBM) has agreed to buy Asian exhibitions outfit Allworld in a $485m cash deal that is expected to enhance earnings in 2017. Ubm shares rally 3.8% to 732p.

Energy industry data suppliers Gtech (GTC:AIM) remains upbeat on the sector's mood for 2017 despite obvious weak spots, prompting a 15% share price rally to 37p.

Proximity marketing technology minnow Proxama (PROX:AIM) collapses as it reports delays to the sale of its struggling digital payments arm and secures £1.8m of fresh growth funding. The shares crash 38% to 0.58p, valuing the business at less than £10m.

Mass spectrometry instrument designer Microsaic (MSYS:AIM) continues to struggle for scale as it reports modest 8% sales growth through 2016. Now faced with particularly tough conditions in one of its markets, 2017 growth rates are being called into question, sparking an 19% share price slump to 3.25p.

Air services firm Air Partner (AIR) is buying fatigue risk management consultancy Clockwork Research. The size of the acquisition is not reported although it's likely to be small, with Clockwork did posting just £707,000 of revenue for the year to 30 June 2016.