Don't bet on a recovery bounce at carpets and rugs retailer Carpetright (CPR). Despite a series of earnings disappointments, the stock remains highly rated and further downgrades could accompany next month's (14 Oct) first-half pre-close update.

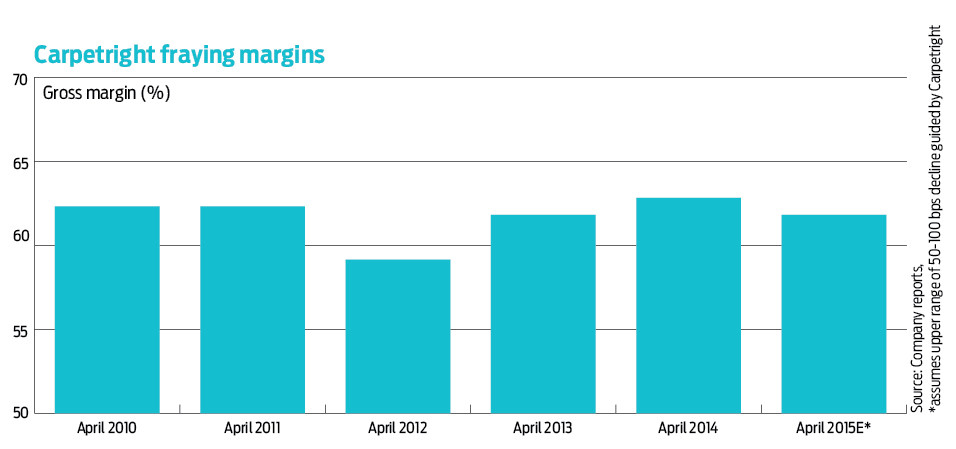

Carpetright's gross margins are under pressure amid weak consumer spending and cut-throat competition. Self-help measures are offering some respite, though the £334.9 million cap has yet to see a real benefit from the UK housing market uptick.

A mixed first quarter update (29 Jul) flagged UK sales up 6.1% like-for-like for the 13 weeks to 26 July. However this was against weak prior year comparators, while hot weather over recent months won't have helped footfall.

Moreover, there was an alarming 260 basis point gross margin decline amid increased promotional activity and a warning of a 50-100 basis point full-year decline. Throw in trading headwinds in Holland and Belgium and full-year consensus pre-tax profits and earnings estimates of £8.58 million and 9.49p could prove overly optimistic.