Investors are celebrating the latest set of results from Lloyds Banking (LLOY) which show a small rise in net profit and lending margins last year.

Net income rose 2% to £17.8bn in the year to December, in line with analysts’ forecasts, while the net interest margin - the difference between what Lloyds pays its depositors and what it charges on loans - actually increased slightly to 2.93%.

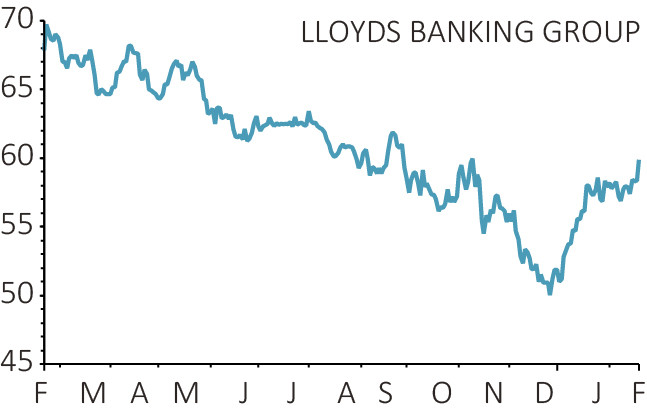

There is more good news on costs, and as hoped the bank is using more of its surplus cash for a share buyback sending the stock up 3% to a three month high of 60p.

REVENUE GROWING SLOWLY BUT SURELY

As the UK’s largest retail and commercial bank and the only one without even a legacy ‘markets’ business, Lloyds just sticks to old-fashioned loans and deposits.

As long as it charges more for loans than it pays on deposits, and as long as those loans don’t go ‘bad’, this style of banking is nice and steady if unspectacular.

Even without a noticeable increase in lending, net interest income rose by a gentle 3% last year as it managed to eke out a small increase in its margin by holding down savings rates for depositors.

The proportion of loans considered bad is 0.21%, which is a tiny increase on the previous year but clearly not problematic, and the bank sees ‘no deterioration in credit risk’ going forward.

As it sticks to its ‘prudent, through the cycle approach’, the net interest margin is expected to stay at around 2.9% for the rest of this year.

COSTS UNDER CONTROL

Total operating costs were slightly lower than 2017 with what the bank calls ‘business as usual costs’ down 4% while investment and depreciation went up.

Charges for ‘remediation’ which includes repaying PPI fell by 30% to £600m last year and the bank expects them to ‘reduce significantly’ this year. The deadline for PPI claims is just over six months away.

Including remediation costs Lloyds still has the lowest cost-to-income ratio of any UK bank at 49.3%: excluding remediation charges that drops even further to 46%.

This leaves it with a strong capital base from which it can reward shareholders with increased dividends and buybacks.

RISING SHAREHOLDER RETURNS

Thanks to its rising top line and its focus on pushing down costs Lloyds is generating serious amounts of cash flow.

Without a ‘markets’ business to blow it on the bank is hiking the dividend by 5% to 3.2p per share giving the stock a 5% dividend yield at today’s price.

It has also increased the share buyback programme from £1bn to £1.75bn.

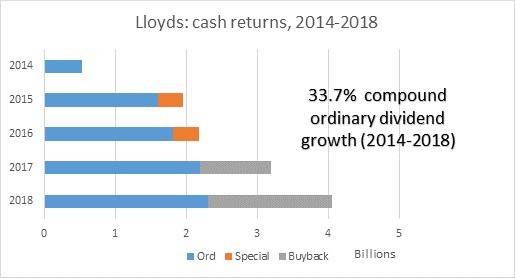

Source: Lloyds Bank, Liontrust

As fund manager Jamie Clark, co-manager of the Liontrust Macro Equity Income Fund, points out, including the increased buyback Lloyds has returned almost £12bn to shareholders since it resumed dividend payments in 2014.

To put that in perspective, the bank's market value before today's news was just under £40bn so it has repaid the equivalent of 30% of its equity.

Even allowing for this increased pay-out, Lloyds’ common equity Tier 1 (CET1) capital ratio - a key measure of its financial strength - is still 13.9% and it is forecasting a ratio of 14-15% for the coming year.