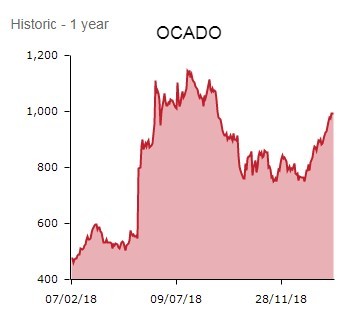

Shares in online grocer-turned-e-commerce technology platform Ocado (OCDO) tick up 3.4p to 996p, despite full year results revealing a materially widened annual loss. Bulls are seizing on chief executive officer (CEO) Tim Steiner’s insistence that Ocado’s growth story is ‘only just beginning’.

Conspicuous by its absence however is any mention of the rumoured food delivery tie-up with Marks & Spencer (MKS) and there’s fodder for bears in the guidance that any new licencing deals Ocado inks would ‘impact short term profits’.

IT WAS A VERY GOOD YEAR

2018 proved a transformative year for Ocado, which signed a further three international partnerships to develop its Ocado Smart Platform (OSP) in Canada, Sweden and the US with Sobeys, ICA and Kroger respectively.

Yet results for the year ended 2 December reveal a dramatically widened pre-tax loss of £44.4m (2017: £9.8m). This reflects ongoing investment in the OSP platform, which more than offset a 12.3% group revenue hike to almost £1.6bn.

The bottom line result also reflects higher depreciation and share-based management charges triggered by Ocado’s high-flying share price, as well as the early adoption of IFRS 15, a contract revenue recognition accounting change that impacts the timing of OSP-related revenues.

STEINER’S STEER

Steiner says ‘our performance last year was the result of many years of focus, dedication and perseverance: what we have called our “18-year overnight success”. Our growth story, however, is only just beginning.

'We now have in place a platform for significant and sustainable long-term value creation as the leading pure-play digital grocer in the UK, a world-leading provider of end-to-end ecommerce grocery solutions, and as an innovative and creative technology company applying our proprietary knowledge to a range of challenges.’

‘CREATING FUTURE VALUE NOW’

Steiner continues: ‘Our transformation journey is well under way with increased cash fees earned and greater investment as we execute on behalf of our partners. Creating future value now will involve us continuing to scale the business, enhancing our platform, enabling our UK retail business to take advantage of all its opportunities for growth, and innovating for the future.'

This is may sound very exciting but Ocado is once again promising jam tomorrow, with success pinned to inking more international deals that are unlikely to translate into bottom line profits for years.

While confident in generating 10%-to-15% sales growth in its retail business this year, Ocado warns of a decline in EBITDA from its solutions (licencing) division given the extra costs of setting up overseas customer fulfilment centres (CFCs). Furthermore, Ocado cautions that any new solutions deals clinched would generate additional cash fees ‘but would impact short term profits’.

Russ Mould, investment director at AJ Bell, comments: ‘Ocado says its growth story is only just beginning but is that simply an excuse for not making a profit?’

‘Despite all the fanfare about signing international deals, the reality is that its financial health is actually getting worse.’

‘The company has guided for a further decline in underlying earnings because it will incur costs of setting up customer fulfilment centres but they won’t become operational in 2019.’

‘To its credit, Ocado has made clear progress strategically with finding overseas players who want to use its technology. But when you are a FTSE 100 company, failing to make a profit is unacceptable.’

'Ocado needs to spell out how material these overseas contracts are going to be to its earnings if it is to win over the army of sceptics.’

Meanwhile Shore Capital says: ‘Whilst we welcome the international deals which will translate into revenues and profits over time, once the CFCs have been delivered we continue to question their materiality and ask when these international deals will make a fundamental difference to both revenue and earnings line and what they will do for return on capital employed (ROCE)?'