Lavendon (LVD), Europe’s leading provider of mechanical aerial platforms, is in demand as a bidding war for the company between rivals Loxam and Thermote & Vanhalst (TVH) hots up.

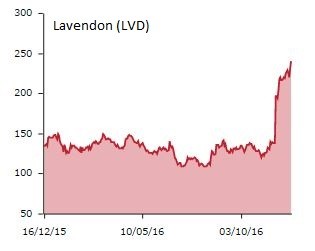

Lavendon’s share price has gained 75% above levels the stock traded at before TVH announced its first 205p a share bid in November, which was rejected even though TVH said it had the support of enough Lavendon shareholders to push through the deal.

Today TVH upped its offer to 230p from 205p and said it has acquired a further 5.4% of Lavendon’s shares taking its ownership to 20.4%.

Investors appear to be banking on another increased offer with shares trading 4.5% higher this afternoon at 242p, a premium of 5% to TVH’s bid.

On November 28, 3i Group-backed Loxam announced a possible rival cash offer for the Leicestershire-headquartered outfit and appears the most likely candidate to launch a counterbid.

In late 2015 it acquired the equipment rental business of Hertz in France and Spain for an undisclosed sum, markets in which Lavendon is also present.

Takeover talk at Lavendon has been driven by a languishing stock market valuation which saw the stock trade 40% lower from an early 2014 peak driven by a slow-down in the UK and ongoing weakness is its European division.

Poor cash collection in the Middle East added to selling pressure on Lavendon’s share price.

More recently, there are signs conditions are improving in Lavendon’s UK and European units. Fleet on hire hit 68% in the UK at the end of June 2016, comfortably above the 50% to 60% level at which the company is able to earn its cost of capital, chief executive Don Kenny said.

Currency movements also providing a tailwind: group revenue gained 9% at constant currencies in the nine months to 30 September 2016 or 15% at actual exchange rates.