Oil company Hurricane Energy (HUR:AIM) is targeting first oil from its Lancaster field in the first half of 2019 at a level of around 17,000 barrels of oil per day. A capital markets day reveals the company continues to work towards a final investment decision on the project, described by the company as the 'largest undeveloped discovery in the North Sea', by the end of the first half.

The company has secured a FPSO (floating production storage and offloading) vessel to produce from the field. Capital expenditure for this early production system (EPS) on Lancaster is expected to come to $467m which could be funded through a mixture of equity, debt and potentially bringing in a larger partner.

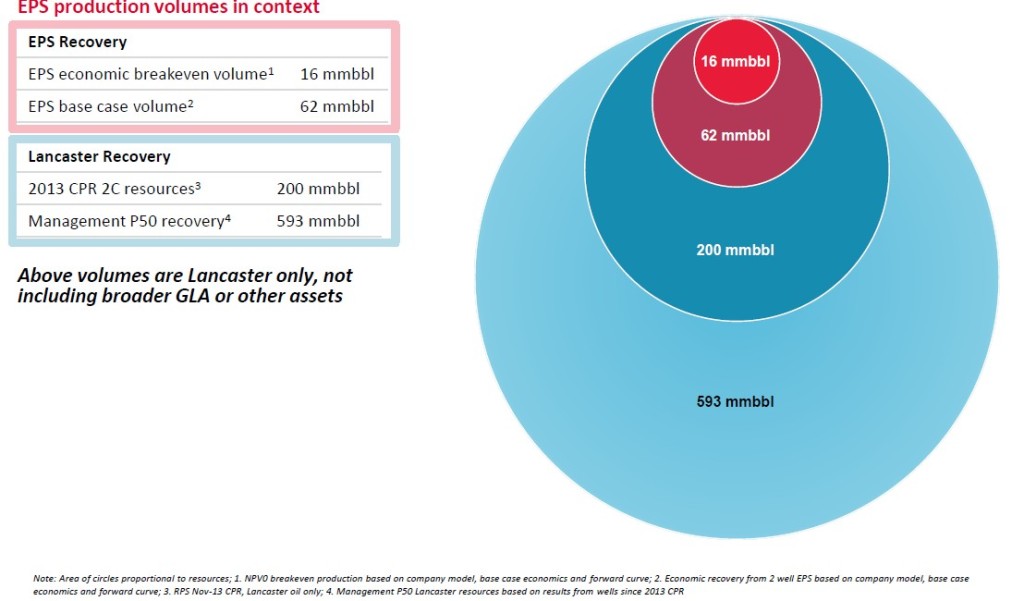

BIG RESOURCE

Internal estimates put the size of Lancaster at 563 million barrels and an updated independent audit is in the offing which could underpin this number. The EPS will only tap a fraction of the field’s full potential as the graphic shows.

Source: Hurricane Energy

FinnCap analyst Dougie Youngson approves of the way deals with contractors and services companies will be structured. ‘In terms of the capex, service contracts have been structured as a 75/25% lump sum versus reimbursable fees. By doing this, Hurricane has mitigated against cost inflation and has passed the operational risk onto the contractors, which we view very positively.’

Youngson has a 'buy' recommendation and 130p price target on the stock, implying significant upside from the current share price of 58.4p.

WHAT ARE FRACTURED BASEMENT RESERVOIRS?

Hurricane is focused on fractured basement reservoirs, which lie underneath the sandstones which have delivered most of the UK’s historic production and have previously been targeted in countries such as Yemen, Libya and Vietnam.

Its drilling in the area West of Shetland in the North Sea has backed founder and chief executive Robert Trice’s theory that this untapped resource could be successfully exploited.