- Microchip kit maker latest tech firm to wield costs axe

- 1,300 jobs to go as it realigns with market uncertainties

- Q2 results beat expectations (almost) across the board

Investors have become used to big tech companies taking the axe to costs in recent months as companies realign to macroeconomic uncertainty. Lam Research (LRCX:NASDAQ) is the latest, joining the likes of Tesla (TSLA:NASDAQ), Microsoft (MSFT:NASDAQ), Amazon (AMZN:NASDAQ) and Alphabet (GOOG:NASDAQ), despite beating estimates in the second quarter.

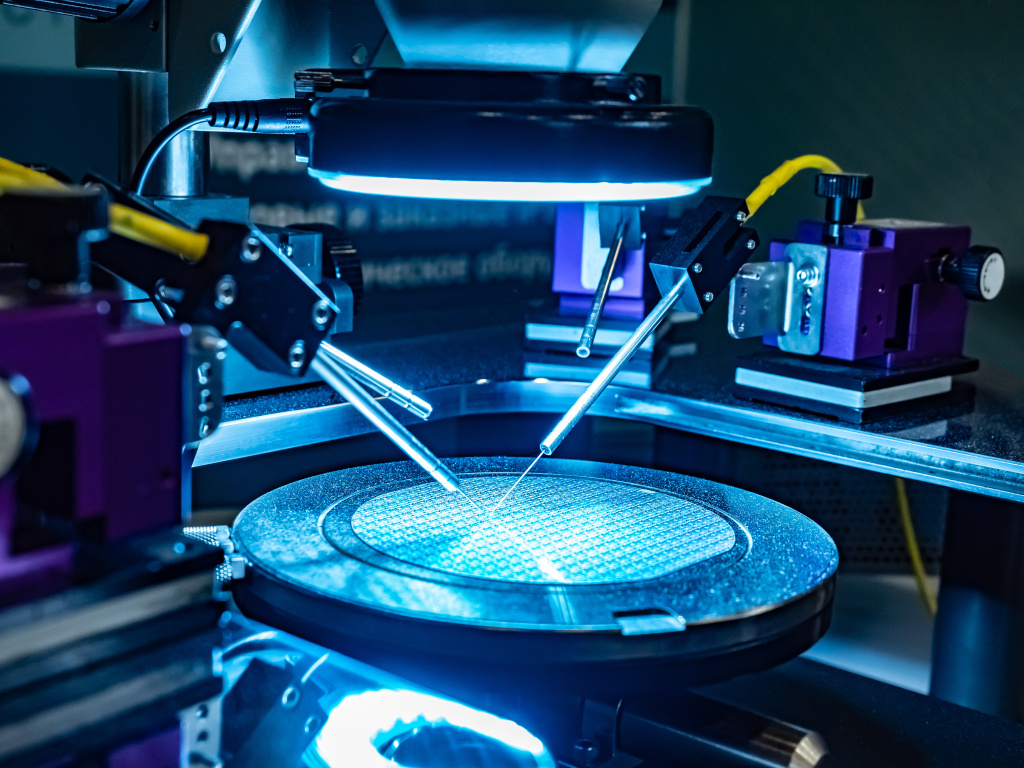

The microchip manufacturing equipment supplier plans to slash around 1,300 jobs (roughly 7% of its workforce) after massaging down expectations for the March 2023 quarter. Revenues, earnings, and margins will all be lower than previously thought, sending the share price into reverse.

The stock is seen opening around 1.5% lower when Wall Street resumes later today, at $480.84.

WHAT'S IMPORTANT LONGER-TERM

A couple of points are worth making here. First, this comes after a strong run for the stock. Since Shares told readers to buy shares in this ‘brilliant company at a brilliant price’ back in October 2022, they have surged more than 28%, even after pre-market falls.

Secondly, managing the expectations of investors is an important part of what a good company does, nipping in the bud euphoria before it takes too firm a grip.

Lam Research reported earnings per share of $10.71 on $5.28 billion revenue in the three months to 31 December 2022, better than the $10.05 and $5.11 billion predicted by analysts. According to Consensus Gurus, the beats were almost universal, with just operating cash flow weaker than anticipated.

This now offers the opportunity for potential outperformance on Lam Research’s reset targets.