There's no doubt that the UK retail environment is in for a sticky patch with consumer spending and rising raw material costs likely to feed through to Britain's high streets down the line. But let's not 'talk' ourselves into recession, retail software seller K3 Business Technology (KBT:AIM) is very much on track.

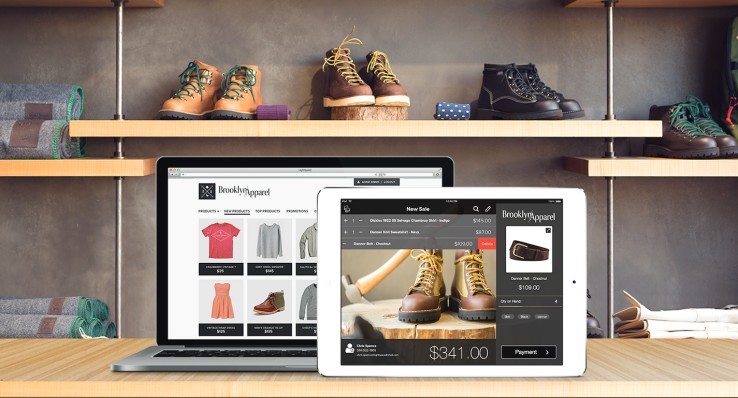

Supplying a host of third party software and systems plus a growing armoury of inhouse development solutions, K3 has its finger on the pulse of an increasingly multi-channel retail world. It's something Shares flagged up quite recently, which you can read about here.

It might be argued that if the high street pinch comes, upgrading IT systems will be among the first costs to cut as retailers retrench. An alternative view is that new technology solutions will be vital in terms of consumer engagement and shopping stimulus, a sort of go-to measure for ambitious retailers to stay ahead of the pack, even if that might mean slower declines rather than faster growth than peers.

So it's very encouraging that K3 notes that it secured a good level of contract wins in the final months of fiscal 2016 and that the new business pipeline continues to provide significant opportunities for the new financial year. So while the top line expansion has slowed, profits are better than ever. Today's short update spells out that the year to 30 June 2016 will be broadly in line with market expectations, which implies a 48% jump in EBITDA to £13.4 million on a more pedestrian 6% increase in revenues to £88.7 million.

That's despite a major customer effectively going to the wall during the period and, importantly, 'a focus on developing its own IP and growing recurring revenues means that the quality of K3’s earnings continues to improve,' rightly points out Lee Prout, analyst at IT analysis boutique Megabuyte.

There's also a clear intention to remain on the M&A path that saw the £110 million company pay £7.9 million for Denmark-based point of sale tech provider DdD in April.

This all makes today's 2% share price decline to 310p seem somewhat cheerless, but perhaps unsurprising given the uncertainties for retail and the wider UK economy ahead.

'We are encouraged by the apparently robust model and look forward to interims in mid September for more detail,' explains FinnCap analyst Andrew Darley today, who underlines his own 465p share price target.