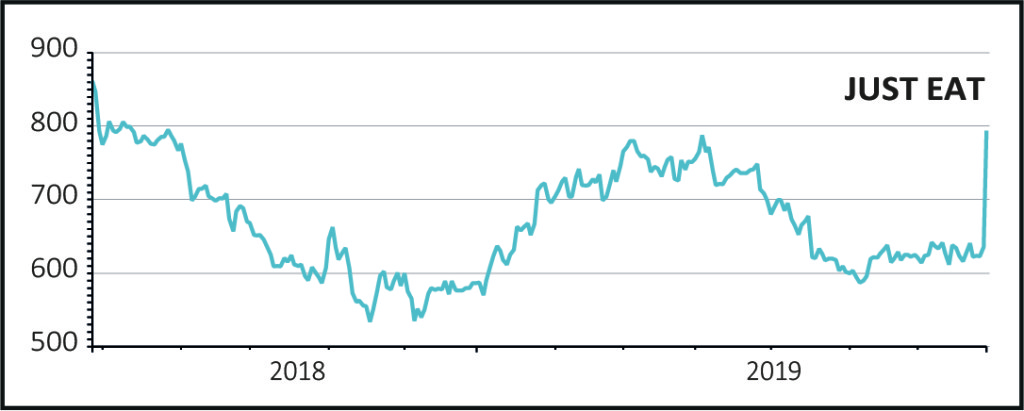

UK fast-food delivery firm Just Eat (JE.) and Dutch-based Takeaway.com have reached an agreement to merge in an all-share transaction that values Just Eat at 731p, a 15% premium to Friday’s price.

However Just Eat shares have jumped 25% to 793p in early trading, perhaps driven by short sellers closing their positions.

According to shorttracker.com there are 50m shares out on loan to short sellers, representing around 7.3% of the company’s shares.

Over the past three months the average daily trading volume has been around 2.2m shares, implying around 25 trading days to ‘cover’ the aggregate short position.

READ MORE ABOUT JUST EAT HERE

Both boards of directors believe that the strategic rationale is compelling, creating a company with leadership positions in the UK, Germany, Holland and Canada and €7.3bn worth of orders in 2018.

They also highlight the ability to combine capital resources and leverage technology and marketing spending across the businesses.

Following completion of the deal, Just Eat shareholders would own 52.2% and Takeaway.com 47.8% of the combined share capital. The deal is structured as a ‘reverse takeover’, that is Takeaway.com is making an offer for the Just Eat business.

Last year Just Eat generated £82.7m of profit from £780m of revenues while Takeaway.com made losses of €14m from €232m of revenues, making the Just Eat business around three times bigger.

Based on these metrics, there is room for Takeaway.com to sweeten the deal for Just Eat shareholders to get it across the line.

The offer should come as no surprise as Connecticut-based activist investor Cat Rock has a stake in both businesses, and in February this year sent an open letter to the management of Just Eat citing a ‘clear rationale’ for the tie-up.

In accordance with UK takeover rules Takeaway.com has until 24 August to announce a firm offer.