THIS IS AN ADVERTISING FEATURE

Find out how the JP Morgan Japanese Investment Trust has delivered a decade of growth and benchmark-beating performance.

BIG IN JAPAN: JFJ'S FUND PERFORMANCE IN THE LAST DECADE

With total assets of well over £1billion[1], the JPMorgan Japanese Investment Trust (JFJ) is now the largest investment trust specialising in the country. The trust has been seeking to provide shareholders with capital growth from a portfolio of investments in Japanese companies since 1927. Whilst past performance is not a guide to the future, the trust has enjoyed a share price total return of 47%, 140.3% and 309% over three, five and 10 years according to independent statisticians Morningstar via the Association of Investment Companies (AIC)[2]

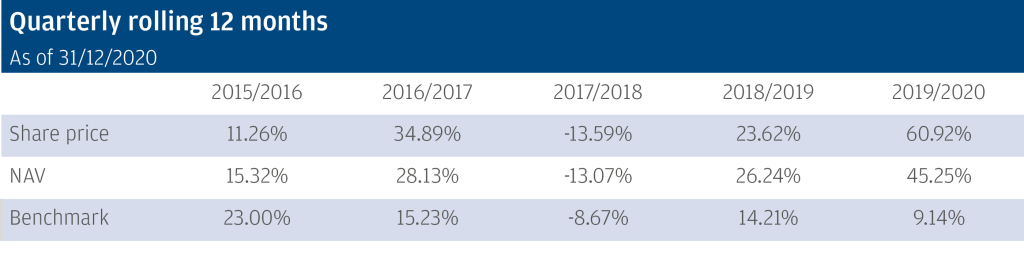

These accomplishments culminated with the trust’s best-ever year in 2020, as it out-performed by 33% and its share price increased by a stunning 60.92%.[3] This was fitting reward for the team in a year that marked a decade at the helm for lead JFJ Portfolio Manager, Nicholas Weindling.

Past performance is not a guide to current and future performance. The value of your investments and any income from them may fall as well as rise and you may not get back the full amount you invested. Source: J.P. Morgan Asset Management/Morningstar. Net asset value performance data has been calculated on a NAV to NAV basis, including ongoing charges and any applicable fees, with any income reinvested, in GBP. Benchmark Tokyo Stock Exchange First Section Index (TOPIX) (£)

CHAMPIONING LOCAL KNOWLEDGE FOR INVESTMENT INSIGHTS

So, how has JFJ continued to achieve such feats? Its diverse, Tokyo-based, team of sector analysts and portfolio managers is now 25-strong. Their in-depth Japanese market knowhow is backed by J.P. Morgan’s global research resources, which makes a formidable combination. The team can leverage the firm’s global network of analysts for insight on, for example, competitors in South Korea, end-demand for Japanese products, and opportunities in themes in which Japan lags behind the global curve (which it does in surprising areas such as digital and ecommerce). Weindling emphasises that there is nothing inherently different or special about investing in Japan, only that: ‘The same trends are apparent here as everywhere else, even if things take longer to play out. This creates tremendous opportunity for long-term active fund managers.’

THE SEARCH FOR LONG-TERM GROWTH

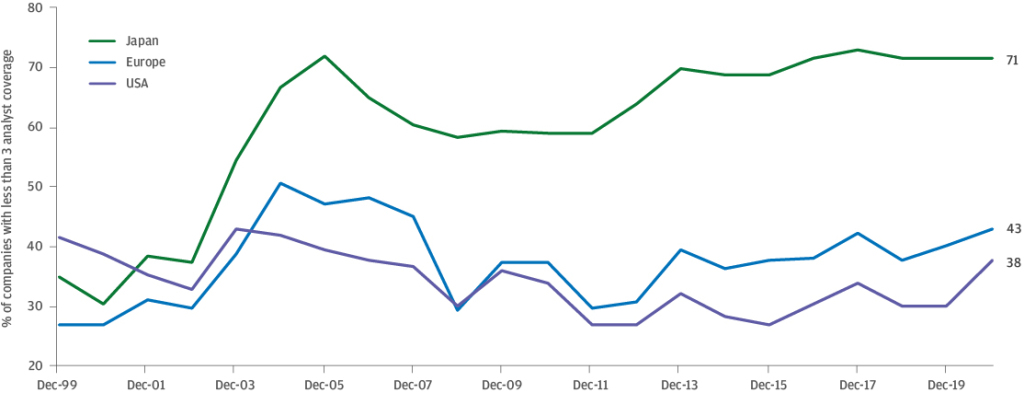

Having such deep research resources - and diverse opinions across the team - are invaluable assets in the search for long-term growth. Being such a vibrant, yet under-researched market helps the team to find exciting prospects, as does the lack of depth in sell-side coverage, especially in the mid- and small-cap space. This hands JFJ a healthy competitive information advantage. The team concentrates its research on companies with great growth prospects over the next three, five or ten years which underpins the trust’s bottom-up strategy while neatly mirroring its growth over the last decade.

JAPAN IS AN UNDER-RESEARCHED MARKET

FINDING GEMS IN THE JAPANESE MARKET

Every year in Japan, 80-100 new companies list - often early in their lifecycle - and the JFJ team is positioned to track intriguing start-ups and meet companies pre-IPO. ‘Every meeting is an education,’ says Weindling. ‘In a single day I can go from discussing telemedicine to adult diapers to pet insurance!’ The team relishes uncovering gems that achieve greatness. Weindling highlights the fund’s holding in M3, a platform for drug companies to market their drugs to doctors, which is up multiple times since first purchased: ‘To watch a stock go from small to mega cap while the investment case plays out as we hoped is very satisfying,’ he says. Another star performer is all-in-one shopping app and payment platform, BASE, likened to a combination of Shopify, Etsy and Stripe, founded in 2012 and now a domestic market leader which experienced explosive growth with the shift to online commerce during the coronavirus pandemic. Having ‘boots on the ground’ proved an invaluable advantage during this period, as the team could still meet companies face-to-face while other asset managers have been restricted by the curbs on international travel.

FREE TO EXPLORE GROWTH PROSPECTS

With a 96% active share, the trust is free to explore across the market cap spectrum, to go ‘wherever the best ideas are’ says Weindling, to ‘invest in the companies in which we have the highest conviction.’ This gives investors an advantage over index-linked Japanese funds which are exposed to monolithic brands and sectors traditionally associated with the country such as auto manufacturing and consumer electronics that face structural challenges and slow growth.

Instead, says Weindling, the team assess potential holdings on set criteria: ‘Do we want to own it in the long term? Does it have the right economics, duration, governance, cashflow, sustainable returns, margin growth, competitive environment, strong balance sheets? and is ESG integrated into everything it does?’ However, the bar is set high: Weindling reveals: ‘few companies in Japan tick all those boxes.’

For Weindling, unearthing the treasures of the Japanese market and adding real value for investors are among the most rewarding aspects of managing the fund. Having such a rich market helps: ‘As a portfolio manager, you want a market where you’ve got the tools to be able to out-perform and Japan is perfect for that.’ Weindling’s passion for out-performance is evident. The trust’s performance speaks for itself. Morningstar awarded it a Silver Analyst Rating and five-stars for both sustainability and its overall rating[4]. This all adds up to a attractive proposition for investors seeking long-term returns. Weindling and the team hope to continue delivering just that in his next decade at the helm of JFJ.

For more information visit www.jpmorgan.co.uk/jfj

[1] GBP 1286.96 Mn as of 31 January 2021. Source: JP Morgan Asset Management/Morningstar.

[2] The Association of Investment Companies as at 15 March 2021

[3] JFJ quarterly rolling 12 month performance as at end of December 2020 (%) 2015/2016 11.26, 2016/2017 34.89, 2017/2018 -13.59, 2018/2019 23.62, 2019/2020 60.92. Benchmark: Tokyo Stock Exchange First Section Index (TOPIX) (£)

Important information

Exchange rate changes may cause the value of underlying overseas investments to go down aswell as up.

External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds and income could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions. This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down. This Company may also invest in smaller companies which may increase its risk profile. The share price may trade at a discount to the Net

Asset Value of the Company. The single market in which the Company primarily invests, in this case Japan, may be subject to particular political and economic risks and, as a result, the Company may be more volatile than more broadly diversified companies.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met.

J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust.

This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP. 0903c02a82b09e83