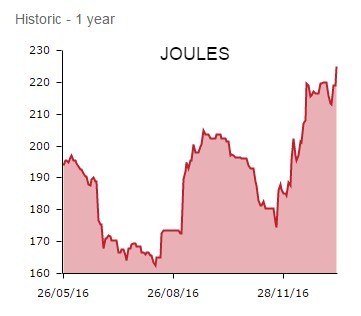

British premium fashion brand Joules (JOUL:AIM) has emerged as an early Christmas retail winner, the shares up another 5.5% to 231p on news of an impressive 22.8% festive sales jump.

This represents an acceleration from the 15.8% growth in the retail business generated in the first half of the financial year, while Leicestershire-based Joules' gross margins are said to ahead year-on-year.

GIVING IT SOME WELLY

Today's trading update from Joules, a running Shares Great Idea, confirms the delivery of strong growth in both new and existing stores with e-commerce supporting the positive momentum in the seven weeks to 8 January 2017.

Broker Liberum Capital explains that Joules took a less promotional stance than peers over the peak selling season, adopting a 'discreet approach' on Black Friday and doggedly maintaining full prices until two days before Christmas in the face of testing market conditions.

The performance validates our positive stance on Joules, an immature growth company expanding through a self-funded store roll-out and with exciting international growth potential in markets including North America and Germany.

Highly cash generative, with a maiden distribution planned for the year to May 2017, the wellies, gilets and jewelley retailer is riding a boom in quality casual attire.

A top selling wholesale brand in Next Label and John Lewis, Joules is also growing from a smaller base than premium lifestyle peers including Ted Baker (TED), out with a better-than-expected festive update today too, and SuperGroup (SGP).

In a notoriously fickle industry, Joules’ distinctive brand has wide appeal and low fashion risk, since the focus is on refreshing or adding something new to proven, timeless classics.

THE ANALYSTS' VIEW

Previously with a 235p target price, broker Liberum Capital writes: 'A disciplined approach to promotions and the strength of the proposition should lead to improved gross margins highlighting the strength of the investment case.

'We remain buyers and while we leave forecasts unchanged, confidence is greater and we increase our target price to 250p.'

As we outlined in December 2016 in Shares, Joules is also among the beneficiaries of the plunge in the pound, being a likely 'staycation' winner.

Liberum explains: 'While the economic outlook remains uncertain and we acknowledge that this brings a fragility to consumer confidence, we believe that Joules could be a key potential beneficiary from the 'staycation' theme, as UK residents may increasingly holiday at home,' due to sterling depreciation.

'This could well be supported by Joules' rural and seaside store locations, providing a smoothing of revenues and driving an incrementally strong performance over summer 2017.

The company's strong focus on value, means that it mixes competitive pricing with high quality products, which positions it well within the fast growing premium lifestyle segment.'

'With festive trading successfully concluded and greater certainty over our full year forecasts (strong growth is evident in the Spring/Summer 2017 wholesale order book, which traditionally offers good visibility over retail revenues) we raise our price target from 210p to 235p,' writes Tejwani.

'While forecast risk has moved to the upside, we await the interim results on 31 January for detail on post festive period clearance rates and markdown,' he adds.