Luxury shoe retailer Jimmy Choo (CHOO) has put itself up for sale in a surprise move that has the backing of majority shareholder JAB Luxury.

The unexpected news sparks an 8% (13.5p) share price gain to 182p for the running Shares Great Ideas selection, whose attractions we highlighted at 133p before Christmas.

UNDER THE HAMMER

The British luxury shoemaker is seeking offers as part of a review of its strategic options to maximise value for shareholders.

In today’s statement, the company says the Takeover Panel has agreed that any discussions with third parties can be conducted within the context of a ‘formal sale process’ under the City Code on Takeovers and Mergers, ‘to enable conversations with parties interested in making a proposal to take place on a confidential basis. The company is not in receipt of any approaches at the time of this announcement.’

Trading from more than 150 stores worldwide, Jimmy Choo is now deemed to be in an ‘offer period’ as defined by the City’s Takeover Code.

SURE-FOOTED STEPS

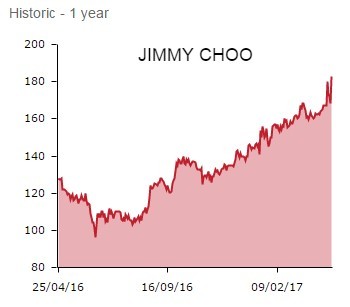

The high-end women’s shoes-to-handbags seller’s decision to put itself under the hammer is perhaps explained by recent share price strength. Following its October 2014 IPO at an issue price of 140p, shares in Jimmy Choo initially struggled, falling to a 95.95p low before the Brexit vote in June of last year.

However, the equity has rebounded strongly and now trades 30% higher than the aforementioned offer price and 90% above last summer’s trough. As such, Jimmy Choo’s owners perhaps feel this is an opportune time to prise the best possible price for the business from any buyers.

Record full year results (2 Mar) revealed 14.5% sales growth to £364m in 2016, albeit flattered by sterling weakness following the vote for Brexit. Jimmy Choo’s outlook statement also flagged ‘improving retail trends across all regions’.

JAB Luxury, Jimmy Choo’s controlling shareholder with a 67.7% stake, says it ‘is supportive of this process. There can be no certainty that a sale of all or any of JAB Luxury's shareholding in Jimmy Choo will take place, nor as to the terms on which any such transaction may take place.'

JAB, part of the investment arm of the billionaire Reimann family, adds that it ‘does not intend to comment further until a decision on possible strategic options has been made.'