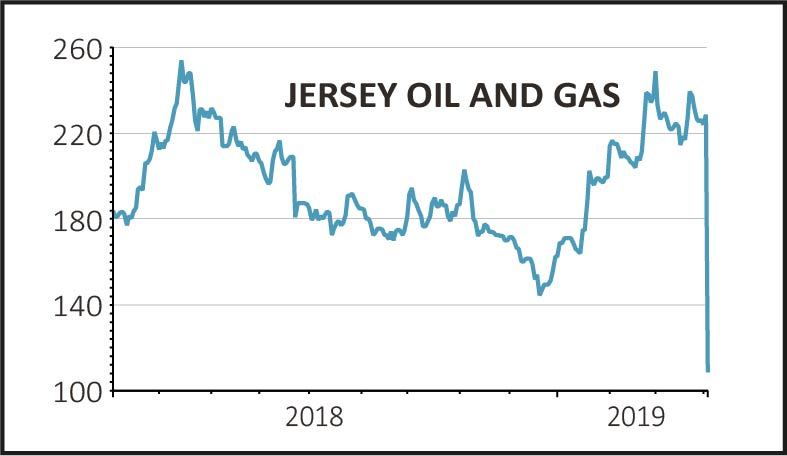

North Sea oil firm Jersey Oil & Gas (JOG:AIM) sinks 55% to 100.8p as appraisal drilling on its Verbier find only confirms the lowest estimates for the size of the resource discovered.

The news is a particular disappointment for Shares given we recently highlighted the potential of the stock ahead of this result.

We felt the risk was more limited than pure oil and gas exploration given there was a degree of certainty that oil was there, it was just a question of how much.

However, today's result was probably as disappointing as it could have been.

The well, drilled in partnership with Norwegian oil giant Equinor (formerly Statoil), failed to encounter Upper Jurassic sands (essentially rock which could contain hydrocarbons).

As a result estimates of the size of the resource are likely to be towards the bottom of the previously guided 25m barrels of oil equivalent (mmboe) to 130 mmboe.

BMO Capital Markets analyst David Round says: 'We are in agreement with the company that the low case of 25 mmboe can be commercially developed with existing and proposed new infrastructure in the area; we value this scenario at around 140p per share.

'Jersey should also find out in Q3/Q4 about the Greater Buchan Area re-licencing awards, which is the next potential key catalyst for the stock.'