Branded sports and casual wear giant JD Sports Fashion (JD.) is buying Footasylum (FOOT:AIM) for a takeout price of £90m.

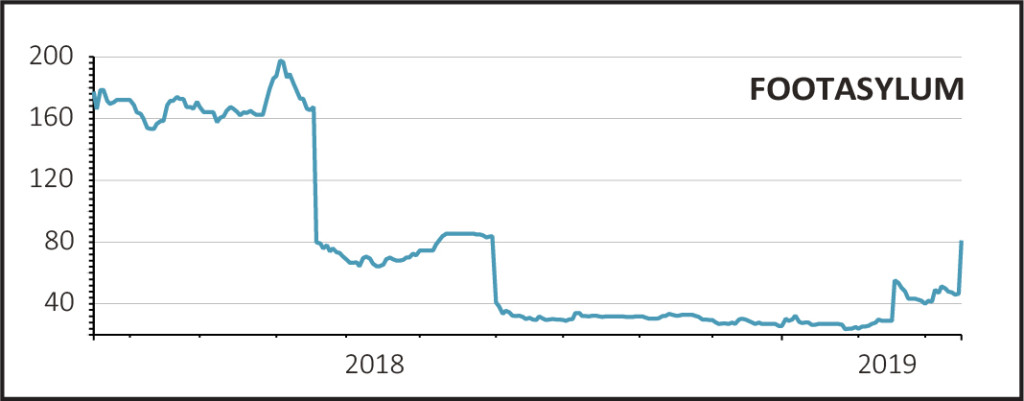

JD Sports is putting its smaller, struggling rival out of its misery, hence Footasylum’s bombed-out shares rally 74.2% to 81p on the news.

The takeover bid comes as no major surprise, since JD Sports acquired an 18.7% strategic stake in February and there is history between the two companies. However on the same day the stake was revealed, JD Sports did specifically state it was ‘not intending to make an offer’ for its embattled high street competitor.

READ MORE ABOUT FOOTASYLUM HERE

Yet JD Sports has agreed a recommended cash offer with the board of Footasylum, the UK-based footwear and apparel seller which has proved nothing short of a disaster since joining AIM at a 164p issue price in November 2017.

Despite selling ‘on-trend’ products aimed at 16-24 year old fashion-conscious shoppers, Footasylum has fallen out of fashion with irate investors following a string of profit warnings and a slew of earnings downgrades.

Footasylum has struggled to deliver against its strategy amid bleak UK high street conditions and weak consumer sentiment, with the need to discount stock crunching gross margins.

To preserve its balance sheet, Footasylum has also scaled back its store opening programme ‘until prospects for greater returns can be identified’.

JD SPORTS TO THE RESCUE

JD Sports is offering 82.5p per share in cash for Footasylum, a bid valuing its Greater Manchester-headquartered neighbour at up to £90.1m. The offer price represents half the level at which Footasylum joined the market, although it does also represent a 77.4% premium to Friday’s undisturbed share price and a 184.5% premium to the level at which Footasylum traded before JD Sports revealed its strategic stake.

JD Sports believes Footasylum is a well-established business with a strong reputation for lifestyle fashion and explains Footasylum’s target customer is slightly older than JD’s existing proposition. ‘In our view, this looks to be a complementary fascia which can benefit from JD’s sourcing scale, infrastructure and potential international opportunity,’ says Shore Capital.

Footasylum generated revenues of £195m and pre-tax profits of £1.9m for the financial year ended 24 February 2018, numbers which are dwarfed by the £3.2bn of sales and £294.5m of taxable profits churned out by JD Sports in the year to January 2018. In terms of valuation, the takeout price of £90m means that JD is paying 7.2 times EBITDA for the company.

Peter Cowgill (pictured below), JD Sports’ Executive Chairman, insists Footasylum is ‘very complementary to our existing businesses in the UK. We believe that there will be significant operational and strategic benefits through the combination of the very experienced and knowledgeable management team at Footasylum and our own expertise.’

Meanwhile Barry Bown, Executive Chairman of Footasylum, says the Footasylum board ‘has concluded that the offer represents the best strategic option for Footasylum and its employees. It believes the offer fairly reflects Footasylum’s current market position and prospects on a standalone basis and, as such, that Footasylum shareholders should be given the opportunity to realise value from the offer.’

Moreover, Footasylum’s management views JD Sports ‘as one of the few businesses which can fully understand Footasylum’s markets, aims and culture and which can, therefore, provide appropriate support and development opportunities to the Footasylum platform to assist Footasylum’s growth'.

WHAT DO THE EXPERTS SAY?

Shore Capital gives the deal the thumbs up from the JD Sports standpoint.

‘In our view, this looks a sensible bolt-on acquisition in the UK to the JD Sports group which crystallises the strategic stake that the company acquired back in February in Footasylum. It brings a further fascia to the group and by leveraging JD’s infrastructure and sourcing capabilities will be able to drive out operating synergies, which can potentially be reinvested in the offer.’

Russ Mould, investment director at AJ Bell, says: ‘Given it snapped up an 18.7% stake in the company in February, today’s £90.1m bid for Footasylum from JD Sports is perhaps not that surprising. However, the company was categorical last month that it wouldn’t make a full takeover offer.

‘Some observers felt the investment was an attempt to block Mike Ashley’s Sports Direct (SPD) from swooping for a direct rival.

'Whether JD’s denials were true at the time, or a classic piece of misdirection, the rationale for the full takeover appears to be that Footasylum offers exposure to a slightly older demographic than the younger teenagers which typically shop in JD stores.

‘On the face of it, the offer looks pretty generous, even if it is a long way short of Footasylum’s market value at IPO of £171m.

‘It has been vulnerable for some time and arguably this move could have happened earlier. Perhaps the involvement of JD’s founders David Makin and John Wardle in the company was a complicating factor.

‘After years of strong growth, JD shareholders will be hoping the company isn’t tripped up by its recent acquisition moves.

‘Early signs from its 2018 purchase of Finish Line in the US have been positive but both it and Footaslyum were troubled businesses before being taken over. As such there has to be some risk they could dilute what has been a highly effective strategy of tapping into the “athleisure” trend.'