- $326 million profit sees $0.18 EPS versus -$0.01 estimate

- Shares fall sharply on slowing growth and aggressive pricing

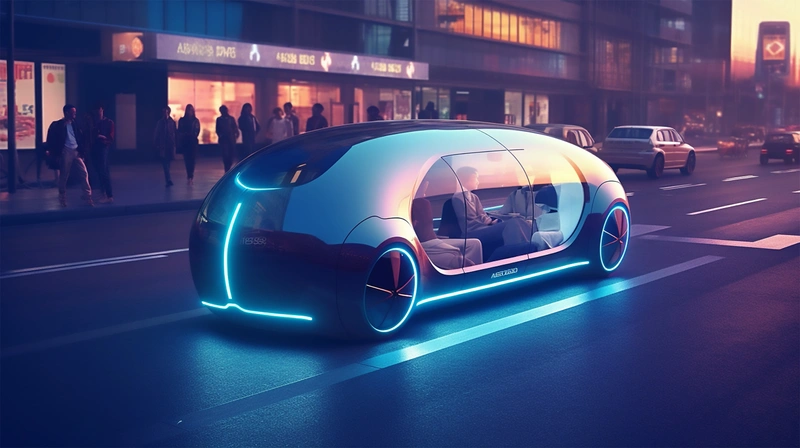

- Prospects may depend on autonomous future Uber envisions

Consumers are refusing to ditch convenience cab rides and takeaway deliveries even in the face of the cost-of-living crisis, which is goods news for Uber Technologies (UBER:NYSE).

The San Francisco-based ride-hailing firm has posted its first ever quarterly operating profit as driver numbers surge back to pre-pandemic levels, and the result was a 26% jump in trips on the platform, record-breaking ride-hailing bookings, and food delivery orders at an all-time high.

FORECASTS SMASHED BUT GROWTH SLOWING

Chuck in much better cost controls and Uber reported pre-tax profits of $326 million (c£255 million) in the second quarter, or EPS (earnings per share) of $0.18, far outstripping the -$0.01 forecast by analysts. In the previous year, Uber recorded a Q2 operating loss of $713 million (c£558 million).

But slowing revenue growth and the emerging threat of a ride-hailing price war, as rival Lyft (LYFT:NASDAQ) mulls cutting fares, saw Uber shares slump nearly 6% on 1 August, with pre-market prices implying another 2% decline when markets open for trading on 2 August.

Why analysts believe Lyft is losing the ride-hailing wars with Uber

Uber’s revenue rose 14% to $9.23 billion in Q2 2023, a slight miss to estimates of $9.33 billion, but growth rates plunged, halving halved from the near-29% increase in Q1 and from above 100% growth a year earlier.

This leaves investors with a big question to face – can the chronically loss-making Uber sustain positive earnings now they have finally arrived, or will they prove to be a flash in the pan?

On the plus side, Uber raised guidance for Q3 2023, projecting EBITDA (earnings before interest, tax, depreciation and amortisation) would reach between $975 million to $1.025 billion, compared with a Wall Street estimate of $915 million.

Bookings were forecast in a range of $34 billion to $35 billion, above the $33.9 billion predicted by analysts.

This would equate to EPS of around $0.03 on $9.51 billion revenue, according to data from Investing.com.

WHAT ANALYSTS PREDICT

Looking further out, Wall Street has high expectations for Uber’s future earnings, with EPS projected to reach $1.09 per share this year, $1.70 in 2024, and $2.34 in 2025. This would imply an impressive increase of 37%, 56.4% and 132.8% respectively, bringing its price to earnings multiple to 20-times in 2025.

According to projections, Uber’s revenue is expected to increase by 18% in 2023 and a further 19% in 2024, reaching $44.51 billion compared to $31.88 billion in the full year of 2022.

Profitable growth could get far more exciting if Uber manages to deploy its vision of fleets of autonomous vehicles seamlessly navigating bustling cities, revolutionising urban transport, food delivery, and logistics services.

This would be huge for profit margins, given the large percentages of rides and deliveries paid to drivers, yet this future is far from certain. That’s the bet investors are making.