Retailers are increasingly looking at multi-channel opportunities and international expansion to win customers and retain loyalty. In the most recent Office of National Statistics (ONS) UK figures (for June), the average weekly online/mobile spend jumped 14.1% to £944.3 million. That works out at 14.2% of all non-petrol retail spending (versus 12.6% a yea ago), with non-food sales worth more than 75% of that.

Fashion is a massive part of this spending shift online, which makes this an interesting time to look at Attraqt (ATQT:AIM).

This is the small online/mobile display technology and inventory control specialist that is leveraging its Freestyle Merchandising platform from the ground up, becoming a trusted digital partner to many otherwise traditional businesses. You can watch our Shares Spotlight video interview with CEO Andre Brown here for more detail.

It published a first half trading update today that is highly promising, sparking a near 6% share price jump to 36p. In the words of N+1 Singer analyst Tintin Stormont, 'Attraqt has delivered a positive half year trading update that highlights strong KPI improvements, an encouraging number of high quality new client wins, healthy sales and production pipelines for the second half and beyond, and confidence in the full year outlook.

She is not alone. 'Highlights include 22 new contracts, 23 year-on-year, including four new clients in North America and 14 new clients in the UK,' states Panmure Gordon's George O'Connor. 'New clients include LK Bennett, The North Face, OKA Direct, The Original Factory Shop, Timberland and Vans, among others.'

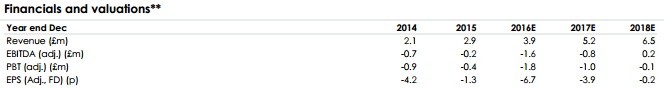

For the record, here are Singer's current forecasts through to 2018.

The company joined AIM last year (19 August), raising £1.25 million from investors at 50p for a £10.3 million launch market valuation. But investor appetite for pre-profit businesses has dried up this year, a fact clearly demonstrated in the company's share price chart.

Shares put the backcloth of this niche tech space into context as far back as September last year, which you can read here. We also added further context in April (click here), and more recently looked at it again earlier this month.

But it does make you wonder whether this might just prove to be an opportune moment for risk happy investors to test the waters. 'We continue to believe that there is the opportunity to create shareholder value well beyond current levels,' says Singer's Stormont today.