As the world’s biggest company, Cupertino tech giant Apple (AAPL:NDQ) is constantly up for discussion, in the mainstream media as well as investment community. But can UK investors seriously consider the stock for their portfolios, especially in light of the recent share price run?

The stock has rallied about 15% since an earnings report on 1 February and is now trading close to all-time highs at $140.88. That values the company at close to $738bn.

Analysts at investment bank UBS raise two important questions that may help investors come to a conclusion.

VITAL QUESTIONS

First, what does iPhone growth look like beyond this year and into 2018 and 2019? Secondly, can Apple innovate to drive long-term revenue growth?

‘We expect double-digit unit growth in full year 2018 (that’s to 30 September) and high single-digit growth in 2019 driven by a growing installed base and high retention rate,’ the UBS analysts say.

They back this up with the thinking that a ‘bulge of 2015 iPhone 6 owners should upgrade in 2018/19, creating a strong year.’

In response to the second question, UBS’s Steven Milunovich says, ‘potentially yes.’

The number cruncher sees several possibilities, but particularly scope to build in augmented reality (AR) features into existing iPhone and iPad devices.

‘Augmented reality is an area in which Apple could leapfrog competition in offering a superior user experience.’

But Milunovich also believes that AR is probably a Goldilocks technology, one that needs to hit some level of maturity before the figurative temperature is just right for Apple users.

NEW GROWTH HOPES

Other opportunities exist, the analyst flagging wearables, home automation, and transportation as areas where Apple could carve itself profitable market share.

Reports indicate Apple took a step back from building its own car to focus on the software and sensor sides of autonomous driving.

The company will probably reassess this strategy down the line, perhaps later this year, according to the UBS man.

But it may make sense for Apple to concentrate on wider technology and applications in a sort of transportation-as-a-service (TaaS) model, integrated into the transport ecosystem rather than selling cars directly consumers.

Speculation that Apple could buy Elon Musk’s Tesla have been going around for months but in a TaaS world, maybe that gossip is barking up the wrong tree.

Maybe Uber is a better candidate. Its reported $66bn valuation is of a scale likely to move Apple’s revenue needle.

That could help Apple stock continue its spectacular outperformance over the S&P 500 during the past 10 years.

In the meantime, UBS estimates 2017 iPhone sales growth at about 4%, ‘on decent reception for the iPhone 7 with a gross margin of near 40%,’ says Milunovich.

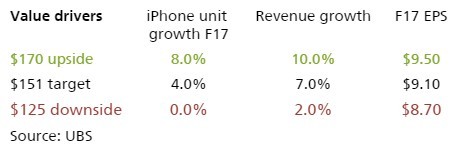

That’s his base case scenario that, according to his valuation calculations implies roughly $9.10 of earnings per share (EPS) and a 16.5-times price to earnings (PE) multiple (14-times on an ex-cash basis) for a $150 share price.

But the analyst has worked through two other scenarios. One implies iPhone growth in 2017 ‘at 8% due to better-than-expected upgrade rates and growth in new customers.’

It also implies renewed investor faith that innovation is strong and potential new products could have impact longer-term. In this case it would mean $9.50 EPS and, with a re-adjustment of the PE to 18-times, would put the shares at around the $170 mark.

Equally, worse than hoped-for iPhones sales and greater long-run growth concerns might drag the stock back to $125 levels.