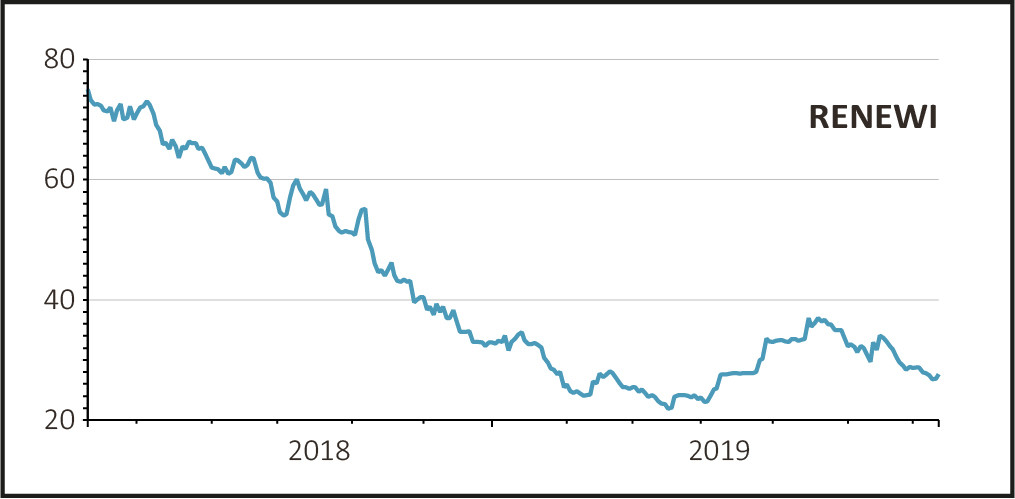

Waste and recycling firm Renewi (RWI) - formerly known as Shanks - is getting a warm reception to its AGM trading update with shares up 3% to 28p on considerably higher than usual turnover.

After a series of downbeat announcements due to delays with its Derbyshire waste-to-energy facility and the shutdown of its Amsterdam incinerator, together with a cut to the dividend, investors were treated today to an upbeat statement and confirmation of its targets for the full year to 31 March.

The Commercial division is trading well ‘with momentum from price increases and synergies more than offsetting cost inflation, particularly for burnable waste, and lower output prices for paper’.

Meanwhile the firm is monitoring the long-term impact ‘if any’ of the unplanned shutdown of its Amsterdam incinerator and the knock-on effect on incinerator capacity in the Netherlands for the rest of this year.

READ MORE ABOUT RENEWI HERE

Also in the Netherlands, the ATM soil-treatment plant has been running at much-reduced capacity while government inspectors continue to test the soil.

Renewi says that tests of its soil inventories ‘have progressed well’ and it is waiting for the go-ahead to resume production. In its last trading update it said it had assumed zero shipments for the year to next March, so positive news on this front will be well received.

Meanwhile the company has been experimenting with separating waste soil into gravel and sand for use as building materials and trial sample samples have been sent to customers for evaluation.

It has also made two small acquisitions in the recycling business in the Netherlands, both of which should strengthen its position in downstream waste-to-product activities and deliver ‘attractive returns’.

Confirming its ‘green’ credentials further, this month it completed the issue of a €75m Green Belgian retail bond (at a coupon of just 3%) which not only gives it more headroom on its borrowing but means it is now fully ‘Green funded’.

It may be early days but today’s statement contains quite a few positives and given the stock’s lowly rating (less than five times 2021 forecast profits) we imagine it won’t be long before value investors, ‘recovery’ funds and potentially ESG funds are beating a path to its door.