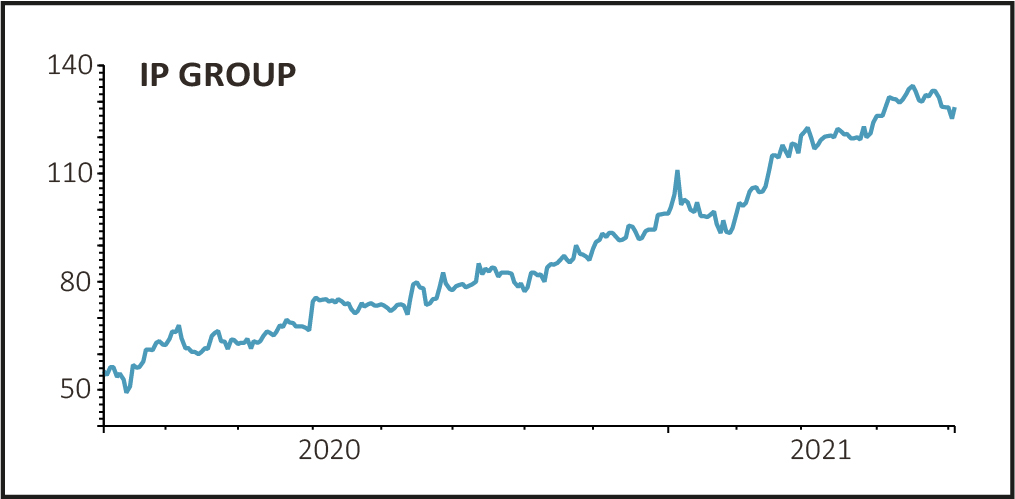

Shares in developer of intellectual property businesses IP Group (IPO) gained 2.6% to 128.5p on Wednesday after announcing that two of its portfolio companies have been acquired resulting in a 4% uplift to net asset value.

Liquid biopsy company Inivata, whose innovative products help to detect and treat cancers, has been acquired by Nasdaq-listed NeoGenomics for $390 million after exercising a fixed price option eight months ahead of plan.

This comes a week after Inivata agreed a distribution deal in breast cancer with the US/Dutch precision cancer firm Agendia. IP Group will receive around $91 million (£66 million or 6.2p a share) in cash or NeoGenomics shares at the company’s discretion.

The company anticipates this will increase net asset value by 2.6p per share subject to the deal passing US antitrust laws and is expected to close in June 2021.

IP Group also announced that its cell therapy holding Kuur Therapeutics has been acquired by the US cancer drug development company Athenex for potentially $185 million.

This will comprise an upfront payment of $70 million (£50 million) in Athena shares and a further $115 million (£83 million) in milestone payments to be paid in cash or shares at the company’s discretion.

After converting loan notes made to Kuur, IP Group will receive $42 million (£30 million) in Athena shares and is eligible for a further $72 million (£52 million). The company estimates this will add around £26 million or 2.4p per share to net asset value.

REALISING VALUE

Today’s announcements come a day after IP Group announced a further funding round at a 33% uplift on the prior fundraising for its largest holding Oxford Nanopore, valuing its 14.5% stake at £359 million.

Nanopore is expected to make its debut on the London stock market in the second half of the year. The uplift in value was already reflected in the 2020 net asset value in March.

Analysts at broker Numis commented: ‘The 4% uplift to the end FY2020 figure of 125.3p/share is nearly half of our target for the year for the portfolio ex-Oxford Nanopore and reflects encouraging progress so far, with the outlook for further progress in 2021 positive.’

IP Group is a running Shares Great Idea and the news flow over the last few months continues to support our original investment thesis with the company realising further value from its portfolio.