Plastics specialist Carclo (CAR) seems to have split opinion among City analysts and investors with the acquisition of US high precision components business Precision Tool & Moulding.

On the one hand the deal, which could cost up to $6.5m (£5.3m) will enhance its North American operations by extending its global services to existing customers. It will also bolster its emerging medical side, where it already works across diagnostic, respiratory, blood management and surgical tools niches.

In the year to 31 December, Precision Tool & Moulding reported pre-tax profit of $1.6m and net assets of $2.2m.

Analysts at N+1 Singer say the deal is well-priced.

Coming from a different viewpoint, there is clear concern over funding, especially the £8m cash call (at 120p per share) proposed to pay for the purchase. While that extra financial muscle will help reduce debt investors are still smarting from a likely axed dividend this year.

That threat has emerged with the decline of bond yields, meaning Carclo will have to substantially raise payments to prop-up its pension deficit.

Carclo derives two-thirds of revenue overseas, but has not fully benefitted from a weaker pound. This is down to currency hedging prior to the Brexit vote, although the company expects to profit if sterling remains weak.

Volatile currency movements have also increased net debt. This apparently has edged 'slightly higher' as of 30 September 2016 versus the £24.75m at 31 March, although the company anticipates that figure declining by the end of this year to 31 March 2017.

Carclo's management remains optimistic. It predicts a strong second half for its supercar lighting business LED Technologies, driven by product demand and on-going project planning. There is also hope that the Aerospace division will meet full-year forecasts, while Technical Plastics is expected to perform better in the second half due to stronger net margins.

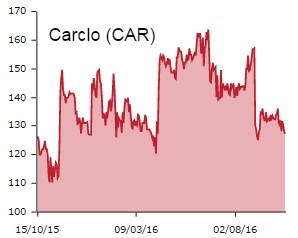

N+1 Singer still believes that the stock remains cheap, flat today at 128p, and is sticking with its 'buy' recommendation.