THIS IS AN ADVERTISING PROMOTION

-Clive Emery, Multi Asset Fund Manager

-Richard Batty, Multi Asset Fund Manager

-David Aujla, Multi Asset Deputy Fund Manager

The Invesco Summit Responsible Range is an affordable range of five, risk-targeted global multi-asset funds, which incorporate Environmental Social and Governance (ESG) considerations into their portfolios.

The fund-of-funds range typically invests in low-cost ESG investment instruments, such as exchange-traded funds (ETFs). These are selected according to a ‘Responsible Asset Allocation’ framework, which prioritises investments that meet certain ESG criteria.

The Responsible Asset Allocation framework was pioneered by the range’s multi-asset fund managers: Clive Emery and Richard Batty, who are supported by deputy fund manager, David Aujla. They work in partnership with the Invesco Investment Solutions team while also benefiting from close collaboration with the experienced Henley Multi Asset team. There is also significant input from Invesco’s global ESG and ETF teams.

Clive Emery said: “By putting ‘Responsible Asset Allocation’ at the start of the portfolio construction process, our proposition offers investors clarity on what drives our responsible investing decisions.”

Responsible Asset Allocation defines the appropriate ESG characteristics of the team’s investments. The two additional and more traditional steps (Strategic and Tactical Asset Allocation) in the investment process aim to enhance the risk and return characteristics of the funds by exploiting market opportunities and mitigating risk, where appropriate.

The five funds in the Summit Responsible Range aim to invest 100% of their assets in ESG investments.[1] The funds are globally diversified and aim to generate long-term returns.

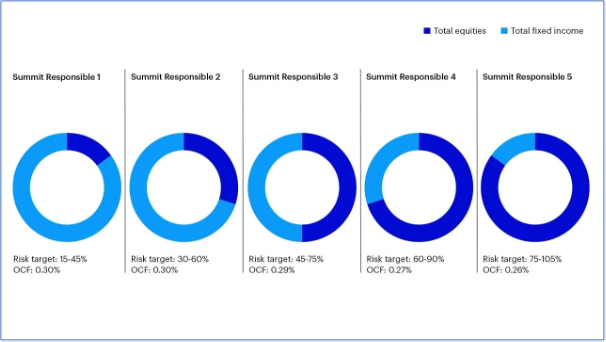

Each fund is managed around a different volatility target - from 15% of global equity[2]volatility to 105% - so it is easy to find one that may match your appetite for risk and return.

This is achieved through a number of asset classes, such as equities, bonds and cash. As the funds increase in risk, so too does their exposure to equities.

Figure 1. Asset allocation - as the funds increase in risk, so too does their exposure to equities

[1] MSCI AC World index

Source: Invesco. For illustrative purposes only. Risk targets are relative to the MSCI AC World index. There is no guarantee that these risk targets will be met. OCF = Ongoing Charges Figure.

The Summit Responsible funds invest in low-cost ESG instruments, such as ETFs, as these offer one of the most efficient ways to gain exposure to financial markets. This means the range can be offered with an Ongoing Charges Figure (annual charge) starting from just 0.26%.

Alexander Millar, Head of UK Distribution at Invesco said: “ESG considerations have become an essential part of financial advice. It’s important that we help investors by offering simple, affordable products that match their ethical values and investment goals.”

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested.

The Invesco Summit Responsible Range has the ability to use derivatives for investment purposes, which may result in the funds being leveraged and can result in large fluctuations in the value of the funds.

The funds' risk profiles may fall outside the ranges stated in the investment objectives and policies from time to time. There can be no guarantee that the funds will maintain the target level of risk, especially during periods of unusually high or low market volatility.

The funds may be exposed to counterparty risk should an entity with which the funds do business become insolvent resulting in financial loss.

The securities that the funds invest in may not always make interest and other payments nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the fund invests, may mean that the fund may not be able to sell those securities at their true value. These risks increase where the fund invests in high yield or lower credit quality bonds.

The funds invest in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise.

The use of ESG criteria may affect the product’s investment performance and therefore may perform differently compared to similar products that do not screen investment opportunities against ESG criteria.

As a result of COVID-19, markets have seen a noticeable increase in volatility as well as, in some cases, lower liquidity levels; this may continue and may increase these risks in the future.

Important information

All information as at 28 February 2022 and sourced by Invesco, unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

For the most up to date information on our funds, please refer to the relevant fund and share class-specific Key Information Documents, the Supplementary Information Document, the Annual or Interim Reports and the Prospectus, which are available on our website.

Issued by Invesco Fund Managers Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.

[1] Invesco Summit Responsible funds aim to invest 100% of their assets (excluding cash) in investments meeting certain ESG criteria. Further information can be found in the Prospectus and Key Investor Information Document.

[2] MSCI AC World index