The chief executive officer (CEO) of Intermediate Capital (ICP) is stepping down in July. Full year results to 31 Mach 2017 show that assets under management (AUM) more than doubled under the seven-year leadership of Christophe Evain, to €23.8bn. AUM increased 10% last year.

Intermediate is an alternative asset manager operating in the private debt, structured lending and collateralised loan obligations markets. These are the types of hard to understand instruments that were at the heart of the 2008 financial crisis.

Such instruments have become popular once again with many investors with returns from more traditional products at historically low levels.

Reasons to be cheerful

While last year's trading performance is very respectable investors seem more fixated by the company’s new dividend policy. The new payout terms will see Intermediate return between 80% and 100% of all pre-tax profit earned by the company’s fund management division.

Profit before tax from the fund management arm (which manages cash for third parties) came 21% higher at £74m, ahead of JP Morgan Cavenove’s estimate of £72.6m. That fed through to a 17.4% increase in the full year dividend to 27p per share. That would imply a payout ratio of fund management pre-tax profit of 107% last year.

Under the new policy, to match last year's full year dividend will require Intermediate's fund management pre-tax profit to grow 6.7% in the year ahead to March 2018.

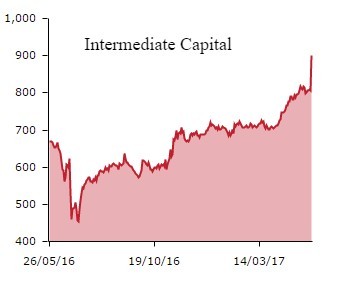

Investors seem to like the new cash returns policy given the rate of growth required to expand the dividend. The share price rallied 12.6% to 909p.

Cazenove also points out the forecast beat from Intermediate's investment division, which invests the company's own money for profit. Here pre-tax profit outperformed expectations by more than 20%, reporting a 43% increase to £163.5m.

Sure footed

While Rae Maile, an analyst at Cenkos, describes Intermediate as ‘sure-footed, like a mountain goat’, it should be remembered that things can change quickly in the world of asset management.

Stiffer regulation is one worry, with a host of new European Commission directives due to come into force in 2018. Cash outflows is another, if investors appetite for complex investment products falls out of favour.

But the company argues that it is better insulated than most, with its customers typically locked-in 6-12 years.

Analysts at Cenkos predict between a 6% and 8% annual rise in future dividends which implies a 28.6p payout (on the lower measure. This equally suggest that fund management pre-tax profit will have to increase by nearly £10m this year to cover the cost under its new payout policy, although Intermediate does have scope to prop up payouts from investment division profits if it must.