Oil services business Hunting’s (HTG) first half results reflect the improved industry backdrop created by rising oil prices.

Restoring the dividend and swinging from last year’s interim loss to a decent pre-tax profit of $38.9m helps support a 10.9% share price advance to 841p. Although the return of the dividend was expected, the promised payment of $0.04 is ahead of the $0.02 penciled in by analysts.

Revenue was slightly short of expectations but this was balanced out by strong margins, underpinned by tight control on costs.

NORTH AMERICAN BIAS

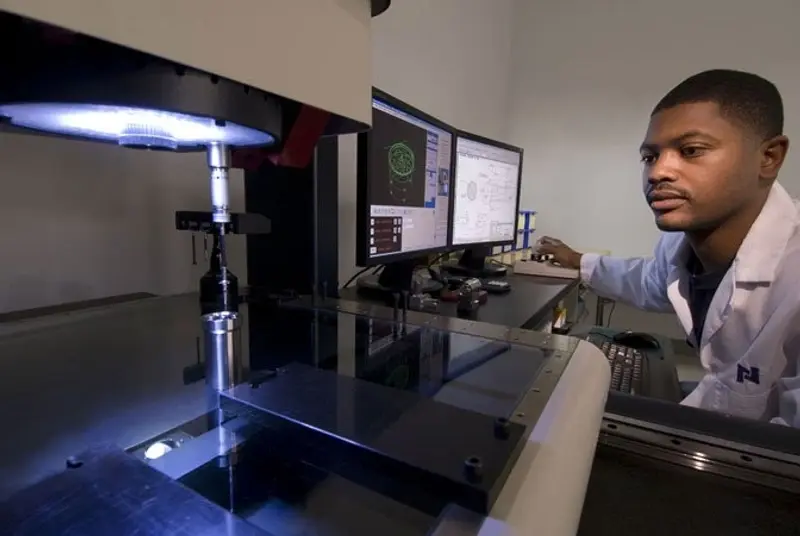

It is important to clarify that this is very much a North American driven recovery. Here the company’s Titan business is benefiting from strong demand for its perforating gun, a device used to penetrate oil and gas wells in preparation for production.

The company is expanding its capacity to manufacture this product and is also investing in R&D to develop an enhanced version.

Outside the US, most of its businesses remain loss making. AJ Bell investment director Russ Mould observes: ‘A more sustainable recovery for the business would require these parts of the group to return to profit too.’

ANALYST’S TAKE

Barclays analyst Mick Pickup is encouraged and reiterates his ‘overweight’ rating and 940p price target.

He comments: ‘With a 20% relative underperformance versus the sector and numbers going up, we see the stock as trading on 11x 2018F EV:EBITDA, falling to 8x next year.

‘For that, investors get exposure to continued industrialization within the US shale market, driven by frac intensity from Hunting’s products, a US non-Titan business that has returned to profitability but is still down by over 80% and a Rest of the World business that we forecast only to be back in the black from 2020F. They also get a reinstated, albeit token, dividend.’