Luxury car maker Aston Martin has confirmed plans to list its shares on London’s Main Market, giving the general public the chance to own a slice of one of the world’s best known luxury brands.

The company has revealed its interest in floating on the London Stock Exchange alongside the publication of its half year results.

More details will be published on 20 September including a prospectus which will include lots of details on how the company works, its financial history and the risks associated with investing in its shares.

WHO CAN BUY AT THE IPO PRICE?

Some companies let the general public buy shares at the IPO (initial public offering) offer price, namely the chance to buy stock at the same price as institutional investors which include insurers and pension funds.

While this doesn’t appear to be the case with Aston Martin, there are two ways in which certain people can pick up shares at the IPO price. First, you would have to be in the lucky position of already working for the company as it says ‘eligible employees’ will be able to buy at the offer price. Otherwise you will need to be a customer to get priority access to the IPO.

So where does that leave everyone else? Put simply, any interested investor will have to put in an order with their stockbroker or investment platform provider to buy shares on the first day of trading as soon as the market opens.

We don’t know the exact date yet, but you can assume it will be some time in October or November. It is likely to qualify for inclusion in the FTSE 100 index in the near future, assuming speculation is correct that the business will be valued at £5bn or more.

We’ll publish a new story once the prospectus is out, summarising all the important information in that document and providing update guidance for the listing date.

MORE ABOUT THE BUSINESS

It is certainly an interesting time for the business to be joining the stock market. Aston Martin has been bankrupt seven times in its history but currently seems to be in good health. A turnaround has been orchestrated by current chief executive Andy Palmer and the business is now firmly back into profitability.

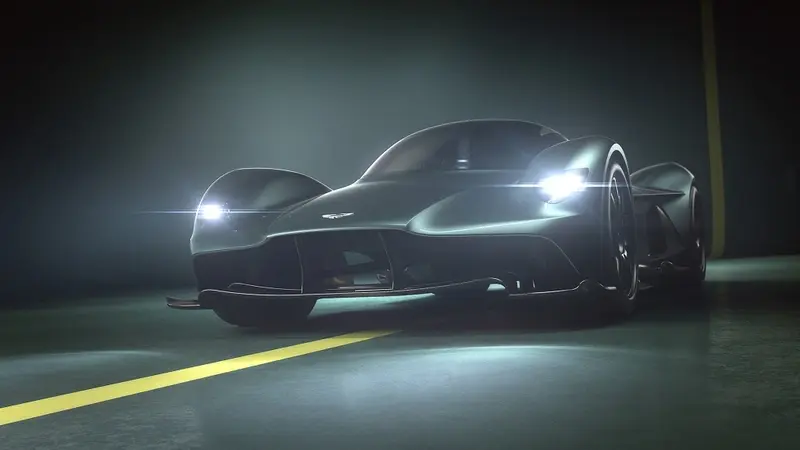

The company plans to upgrade its products and expand into new and existing markets. The core focus is on sports and touring cars, SUVs and sedans. It will reintroduce the historic Lagonda marque which the company believes will be the first all-electric luxury automotive brand.

Other plans include launching a range of heritage vehicles at a pace of one per year.

WHERE DOES IT EARN ITS MONEY?

Aston Martin currently generates 30% of its sales from the UK, 26% from the Europe (ex-UK), Middle East and Africa, 25% from the Americas and 16% from Asia Pacific. It wants to have a bigger presence in emerging markets, particularly Asia Pacific.

Product innovation is also at the heart of the business with initiatives underway including powerboats and submarines.

Aston Martin’s IPO could trigger a re-rating in Ferrari’s shares. Read our article to learn more.

‘Hundreds of thousands of people across the UK will have dreamed of owning an Aston Martin car with its price tag sadly out of reach for most. Now is their chance to finally own part of the Aston Martin empire, albeit a slice of the company rather than something that will take them soaring through the rolling hills of the British countryside,’ says Russ Mould, investment director at AJ Bell.

‘Buying shares in the company is likely to be much cheaper than buying a car, although the equity rating on which Aston Martin trades is likely to be a separate debate. A very strong brand, a return to profitability and clear momentum with new product innovation would suggest it could command a premium stock market valuation once it joins the market.’