The UK housing market, which by most measures was in a dire situation last year, has sprung into life following the Conservative election landslide in mid-December.

The Royal Institute of Chartered Surveyors (RICS) quarterly confidence indicator jumped to a net 35% of positive respondents in December against 12% the previous quarter despite more than half of the responses coming in before the election result. This implies that had the survey been run at the end of the quarter the increase might have been even greater.

Figures from banking body UK Finance show that UK banks approved the most mortgages in four years in December. Mortgage approvals hit 46,815 last month, the highest level since August 2015. This contrasts with a moribund mortgage and home-buying market for most of 2019 and it’s likely that the positive sentiment generated by the election will create a further rise in demand.

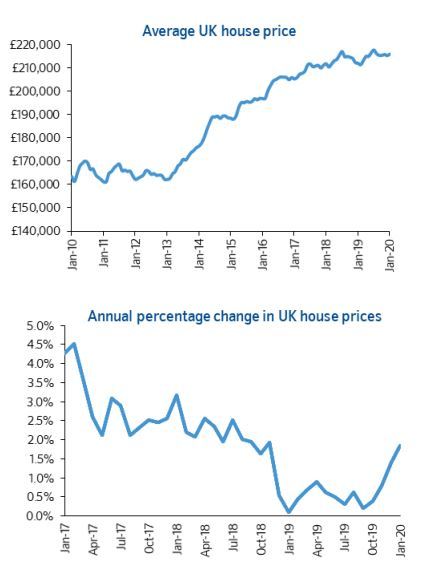

Source: Nationwide building society

Increasing confidence is already starting to feed into house prices, with the Nationwide house-price index gaining 1.9% this month compared with January 2019. With unemployment at historic lows, borrowing costs kept low by competition among lenders and government schemes such as Help to Buy, first-time buyers are driving the increase in demand for housing. The level of home ownership among 25 to 34 year-olds turned up in the second half of last year after declining for the past 15 years.

The housebuilders have out-performed the FTSE 100 comfortably so far this year. Taylor Wimpey (TW.) is the best performer up 12.8%, closely followed by Persimmon (PSN) which is up 12.3%. Rivals Barratt Developments (BDEV), Bellway (BWY), Countryside (CSP), Redrow (RDW) and Vistry (VTY) have all gained between 6% and 8% while the FTSE 100 index is down 0.5% since the start of the year.