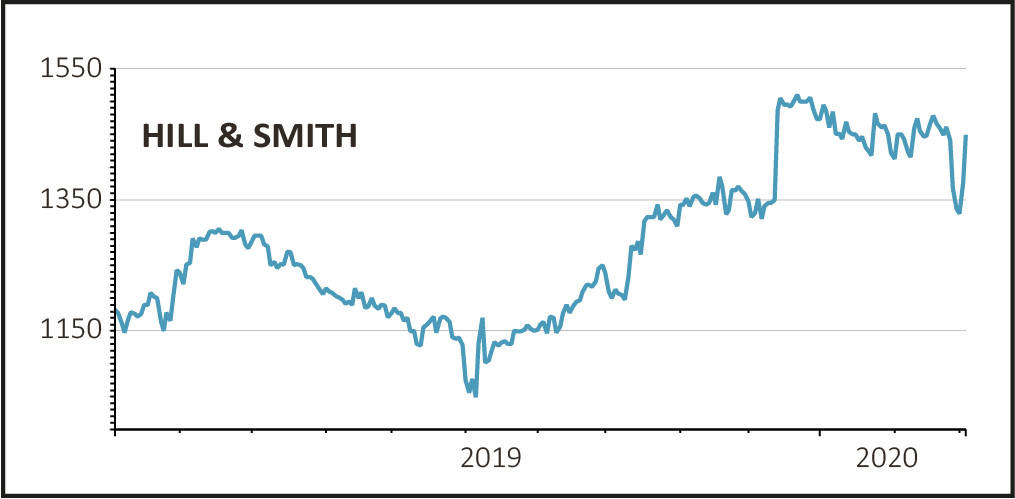

Shares in infrastructure products firm Hill & Smith Holdings (HILS) were the top performers on Wednesday, gaining 6.2% to £14.60 after it delivered a strong set of 2019 results led by its performance in the US.

The company’s main products are crash barriers for motorways, safety railings and security fences for the industrial, transport and utility sectors, steel floors and ladders for factories and oil rigs, industrial cooling towers and galvanised poles for street lighting.

ROAD SAFETY

Group revenues for the year to December were up 9% to £694.7m while operating profits were up 8% to £86.3m, all pretty much in line with management and the market’s expectations.

The Road Infrastructure business, which accounts for just over a third of revenues and a quarter of profits, saw an 18% increase in turnover due to record demand for temporary road barriers in the UK.

The current five-year UK Road Investment Strategy (RIS) 1 programme is due to be followed this April by RIS 2, with government spending expected to be £25.3bn, a 66% increase over RIS 1.

As a leading supplier to the sector, Hill & Smith is well placed to benefit from the uplift in investment which RIS 2 brings.

Unusually for a UK company, Hill & Smith is also a leading supplier of equipment to the US infrastructure market, in particular road safety products such as crash barriers and road messaging systems.

US spending on road infrastructure is ‘robust’, and in fairness it needs to be because like a lot of other US infrastructure it badly needs updating.

INCREASED SECURITY

The Utilities Infrastructure business, which also accounts for a third of revenues and a quarter of profits, saw a smaller increase in turnover last year as UK companies reined in their spending due to political and economic uncertainty in the lead-up to the election.

However investment in security solutions increased and despite a drop in the number of large projects begun last year the firm is positive on the outlook for growth, particularly around critical infrastructure such as data centres, military facilities and power plants.

Another area of growth was temporary and permanent security structures for high-profile events and venues. The firm’s Hostile Vehicle Mitigation (HVM) products saw strong demand and the firm believes this could be a significant growth market going forward.

With that in mind it formed a Roads & Security division in January to bring together its businesses providing protection to people, buildings and infrastructure and offer a coordinated global service.