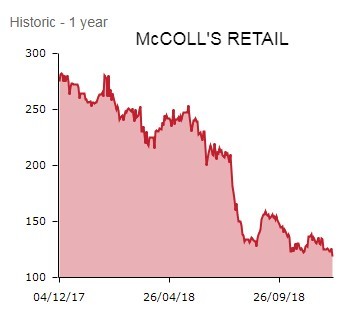

Convenience retailer McColl’s (MCLS) crashes 23.4% lower to 91p after warning full year earnings will fall short of forecasts amid ongoing supply chain disruption and difficult trading conditions.

The neighbourhood retailer also massages down current year profit expectations, citing ‘intense’ grocery sector competition and ‘significant cost pressures’, principally higher wages.

WHAT’S BEHIND THE LATEST WARNING

Following the collapse of wholesaler Palmer & Harvey, McColl’s Retail, trading from 1,556 convenience stores and newsagents, experienced ‘significant supply chain disruption’ and has needed to accelerate the rollout of products supplied by Morrisons (MRW) to 1,300 of its stores.

Unfortunately, ‘the speed of this transition has created significant challenges and severely disrupted our plans for the launch of Safeway’, laments McColl’s.

‘We are extremely grateful for Morrisons’ support during this period, and whilst the transition is now complete, we are continuing to experience a number of challenges. We are working together to address these issues and to develop an optimal range and promotional offer for the future.’

Furthermore, a stronger performance in tobacco, relative to other higher gross margin categories, ‘has resulted in a lower conversion of sales to profit than anticipated’.

As a result, McColl’s expects adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) for the year ended 25 November 2018 ‘to be around £35m.’

Downgrading its price target from 150p to 100p, Liberum Capital is now looking for adjusted EBITDA of £34.8m, a whopping downgrade of £9.5m or 22%. The broker also reduces its dividend assumption from 10.3p to 8p.

AND THERE’S MORE

McColl’s compounds the doom and gloom with the revelation it is expecting ‘continued uncertainty for consumers which will require us to demonstrate further competitive retail pricing’; in a nutshell, another wave of price cuts suggests adjusted EBITDA for full year 2019 will be ‘no more than a modest improvement on full year 2018’.

This is especially disappointing given that Liberum was previously looking for £47.1m of adjusted EBITDA; the broker also pares its 2019 dividend estimate for McColl’s by the best part of 30% to 8.2p.

In some positive news, McColl’s reveals that year-end net debt is materially lower than expected at roughly £100m thanks to good working capital management and greater sale and leaseback proceeds than predicted.

McColl’s sold-off heavily following poor half year results (23 Jul) and a profit warning back in the summer, blaming the aforementioned administration of Palmer & Harvey and the ‘Beast from the East’ for a slump in half year profits.

In today’s statement, chastened CEO Jonathan Miller comments:

‘2018 has been a very difficult year for the business, marked by unprecedented supply chain disruption and ongoing challenges.

‘Looking ahead, we expect competition in the grocery retail sector to remain intense and we face into significant cost pressures.’

Russ Mould, investment director at AJ Bell, says McColl’s ‘looks to be in the middle of a tough period, although it will hope this is only a temporary setback.

‘The long-term goal is to have Morrisons supply both Safeway and branded products to McColl’s, potentially putting it in a stronger position to fight competition in the convenience store space. The near-term challenge is to improve availability of products and get them priced in the best fashion.

‘While it irons out these issues, we’re told earnings will be lower than previously expected. That begs the question whether the dividend will also be cut at the end of the financial year.

‘The grocery industry is incredibly competitive and operators have to do everything they can in order to drive sales and keep costs under control. Any slip-up can have disastrous consequences and put a business back both financially and strategically, and that’s exactly where McColl’s sits today.'