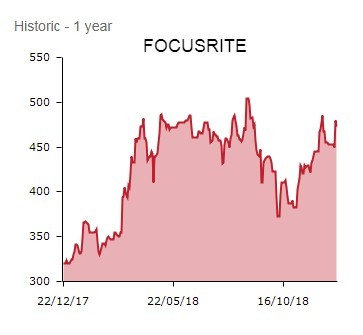

Global music and audio products innovator Focusrite (TUNE:AIM) is very much back in the growth groove with investors, the shares boogying 30.5p or 6.5% higher to 503p on a short but sweet-sounding market missive.

Trading was strong in the key pre-Christmas month of November, having been ‘broadly similar’ in September and October. This leaves Focusrite’s first quarter (Q1) ahead year-on-year, news which will be music to the ears of investors given the numerous downbeat pronouncements from UK consumer-facing stocks in recent weeks.

In a well-received annual general meeting (AGM) update, executive chairman Phil Dudderidge says: ‘When we announced our full year results on 20 November 2018, we commented that trading for the year to date was broadly similar to the prior year.’

However Dudderidge, who was Led Zeppelin’s first dedicated live soundman, then adds: ‘November 2018 was a strong month and our revenue for the financial year to date is now ahead of the comparative period last year.’

MAKING ALL THE RIGHT NOISES

The positive November result is significant because last year’s first quarter was itself a strong one, driven by a boost in pre-Christmas demand, although Edison Investment Research analyst Paul Hickman makes no change to his full year forecast which calls for a modest 4% increase in pre-tax profits to £11.8m.

‘Focusrite reports a strong November, leaving its Q1 ahead year-on-year, a positive result compared with many retailers,’ explains Hickman. ‘While its wide international spread is helpful, uncertainties remain on consumer markets generally, on US tariffs and on Brexit. We retain a cautious forecasting stance, while the valuation reflects the ongoing potential of its market-leading brands.’

GOING GLOBAL

Near-term uncertainties notwithstanding, growth remains the overarching theme at High Wycombe-headquartered Focusrite, whose proprietary hardware and software products are used by audio professionals and amateur musicians alike.

Focusrite’s global expansion is being furthered with the help of marketing offices in Los Angeles and Hong Kong. And following better-than-expected full year numbers, Shares said we were excited as ever about its growth prospects.

Cash-generative Focusrite also increased the dividend by 22% to 3.3p and with year-end net cash of £22.8m, it certainly has the funds to invest in a growing new product pipeline and scout for earnings?accretive acquisitions.