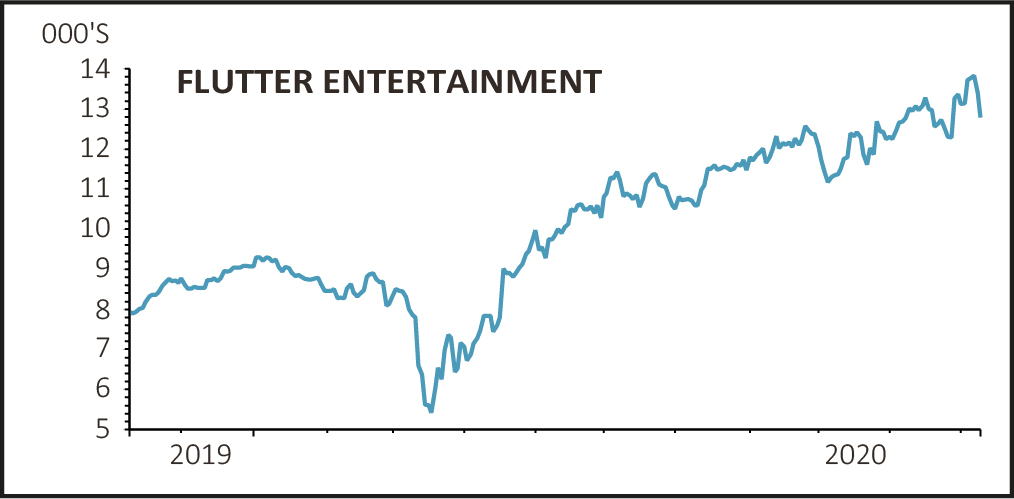

Shares in gambling firm Flutter Entertainment (FLTR) pushed 3% higher to £131.70 as it enjoyed a third-quarter performance that was ahead of expectations with revenues growing 30% year-on-year, prompting management to upgrade its full-year profit guidance by 2%.

Paddy Power and Betfair owner Flutter generated 41% growth in average daily customers with double-digit gains across all key regions. The stand-out performances came from Australia and the US.

In Australia revenues grew 76% thanks to average daily customer growth of 86%, with the group benefiting from the structural shift to online as local lockdowns and social distancing restrictions remained in place.

STRONG US MOMENTUM

The company maintained its leading position in the US taking 46% of the online sportsbook in regions where it operated and 29% overall online share which includes gaming.

Revenues increased by 82% to £161 million with gaming revenues growing 299% to £62 million, aided by average daily customers increasing ‘more than five-fold’ during the quarter.

The racing business operating under the TVG (Television Games Network) brand increased average daily customers by 112% which helped to drive revenue growth of 54% across TVG and the daily fantasy sports businesses. The leading fantasy brand FanDuel doubled its active sportsbook customers year-on-year.

FanDuel became the exclusive sportsbook integration partner for Turner Sports under a five and a half year partnership deal. A six-year deal was signed with Entercom, the leading sports radio group for FanDuel to become its official sportsbook partner.

Russ Mould, investment director at AJ Bell commented, ‘FanDuel is of particular importance where it lets customers create fantasy teams made up of real players from professional sport and play against other users.

‘That’s one of the fastest growing parts of the gambling market in the US and it is now making waves in Europe. Flutter was clever to spot this opportunity by taking a controlling stake in FanDuel two years ago.’

INCREASED GUIDANCE

Continuing strong momentum in the US means the group is now expected to generate gross gaming revenues over $1.1 billion in 2020 and net gaming revenues over $850 million.

Management have accordingly increased customer acquisition investment which is expected to lead to higher earnings before interest, depreciation and amortisation (EBITDA) losses of between £160 million-to-£180 million, up from £140 million-to-£160 million.

Excluding the US full-year 2020 EBITDA expectations have been upped by 2% to between £1.275 billion-to-£1.35 billion.