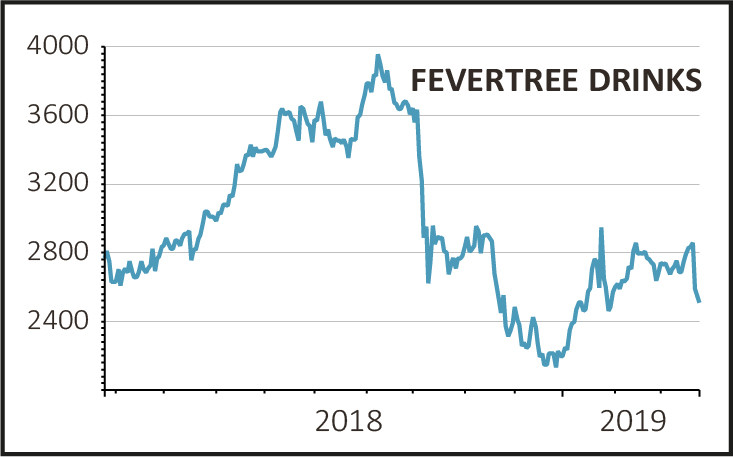

Shares in premium mixer-maker Fevertree Drinks (FEVR:AIM) were shaken in early trading, losing as much as 9% to £23.50 before recovering to trade flat on the day at £25.40.

The company beat market estimates with its full year 2018 sales but was cautious not to stoke expectations for the current year so early on, describing trading as ‘in line with expectations’.

Traders saw this as an opportunity to push the shares down but the sell-off lasted little more than an hour.

Sales in the UK grew by 55% last year as the brand gained more shelf space at the big supermarkets (the ‘off-trade’) thanks to the introduction of its low-calorie Refreshingly Light range and limited editions.

READ MORE ABOUT FEVERTREE HERE

Meanwhile the trend towards simple long drinks and away from wine and beer continues to drive sales in hotels, bars and restaurants (the ‘on trade’).

European sales grew by 24% driven by demand for premium tonic as the craft gin movement gains momentum and retailers give more shelf space to mixers. Also long drinks are taking market share from beer in Europe for the first time.

US sales grew by 21% with an acceleration in the second half thanks to the firm taking direct ownership of operations and signing a new distribution deal with SGWS, the largest wine and spirits distributor in North America.

The relationship with SGWS has grown with Fevertree now the US group’s preferred mixer partner. This had led to co-promotions such as Citrus tonic water alongside Patrón Tequila, the biggest premium tequila brand in the US.

Overall the results show strong progress and the board is right to be ‘excited about the size of the opportunity that lies ahead’, even if it didn’t push the boat out with its forecasts.

Read our latest view of Fevertree Drinks here.

Disclaimer: The author owns shares in Fevertree Drinks