FTSE 250 iron ore producer Ferrexpo (FXPO) has declared a bumper shareholder payout after taking full advantage of the surge in iron ore prices.

The company has proposed a special interim dividend of $0.396, taking total dividends for 2020 to $0.726 US, up from a total of $0.198 paid in 2019.

It comes as the Ukrainian miner, in its full year results to 31 December 2020, reported a 46% jump in underlying EBITDA to $859 million, compared to $586 million the previous year.

Revenue rose 13% to $1.7 billion, reflecting rising production volumes and the firm’s destocking process in the first half of the year.

The firm also swung from a net debt position of $281 million to a net cash position of $4 million as demand soared for the higher grade iron ore pellets it produces.

Iron ore, a key ingredient in making steel, has surged over 75% in the past year, mainly on the back of strong demand from China, the world’s largest iron ore consumer.

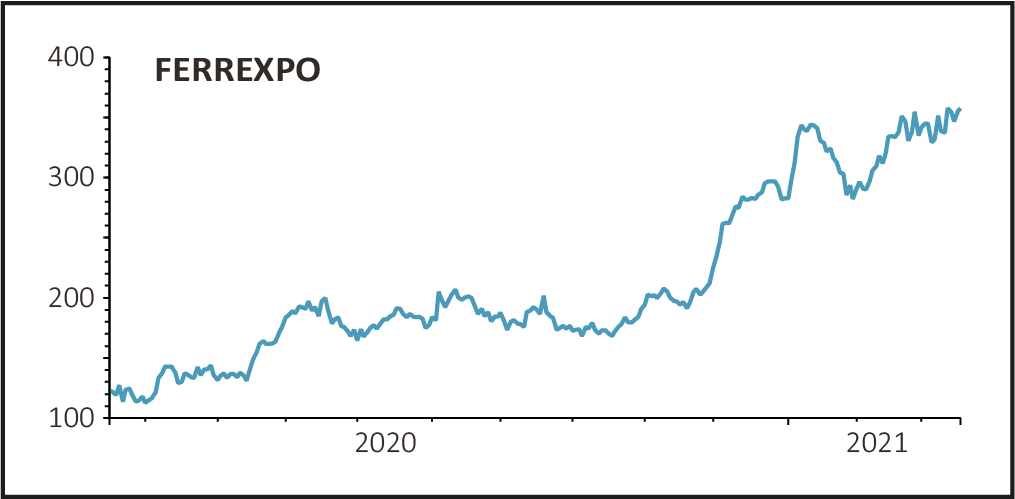

SHARES PAUSE AFTER 200% GAIN

The stock was down 0.5% to 353.4p in morning trade despite the bumper payout from Ferrexpo, but this pause in the shares is largely down to the fact they’ve risen almost 200% since March last year as investor sentiment began to recover and the iron ore price started surging.

An understandable question for investors is whether or not iron ore prices can stay at their current levels and what it means for Ferrexpo.

Speaking to Shares, the firm’s acting chief executive Jim North pointed out its strong full-year results came despite the iron ore price only starting to surge in the fourth quarter of 2020, with the average realized price for its product actually 4% lower for 2020 as a whole compared to 2019.

Going forward North sees demand for iron ore pellets remaining strong at least for the first half of 2021 and said, ‘If you look at the stimulus in the US and the steel demand there, and in Brazil where (iron ore miner) Vale has said the majority of its production will be used domestically to support the economic recovery from Covid, there is a really strong shortage of pellets and while we might see some softening in the second half, it has pushed premiums higher than what we had forecast.’

TWO TIER IRON ORE MARKET

Ferrexpo remains upbeat on the structural demand for its iron ore pellets, and sees increasing environmental controls as a positive for pellet demand in the short term, with more focus on ‘green steel’ or ‘carbon free steel’ boosting demand over the medium term.

North believes iron ore could end up in a ‘two tier market’. He explained, ‘We think it will play out as a differentiator between low grade and high grade iron ore. As you move into a decarbonised world, steel producers are going to be looking for higher grade products.’