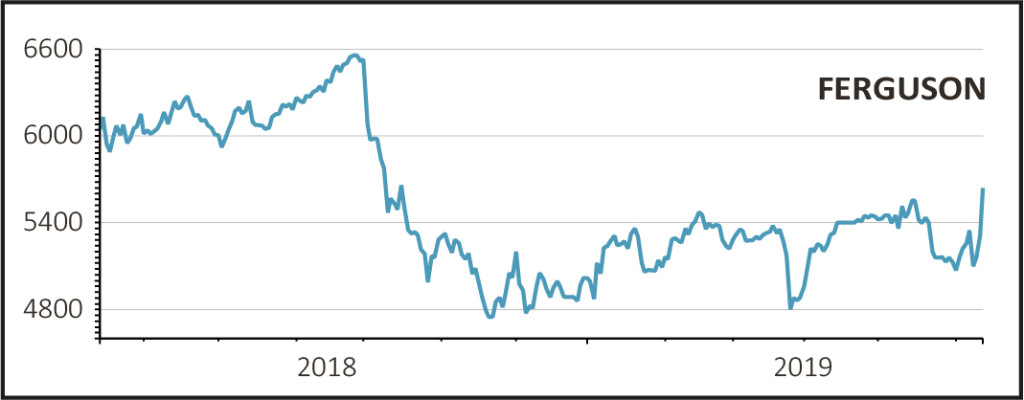

Shares in plumbing and heating supplies firm Ferguson (FERG) have shot up more than 6% to £56.40 after an activist investor took a meaningful stake in the business.

American Billionaire Nelson Peltz may not be a well-known name to many UK investors but he has been wringing value out of businesses he believes are underperforming for years.

News that funds managed by Peltz's Trian Fund Management arm have taken a 6% stake in Ferguson is clearly plenty to get investors excited. The stake makes Trian Ferguson's second largest shareholder with considerable clout.

READ MORE ABOUT FERGUSON HERE

Founded in 2005, by Nelson Peltz, Peter W. May and Ed Garden, Trian is a multi-billion dollar investment firm employing around 50 investment experts. Describing itself as a ‘highly engaged shareowner’ with operational expertise, the Trian model is to spot quality businesses that have endured a spell of poor performance.

Working with management, and pushing them along when necessary, Trian looks to action new strategic and operational ways to release shareholder value.

The company often details its proposals and investment rationale by writing white papers, which it uses as points of discussion with the management team of a portfolio company.

LATE TO THE PARTY?

The question is, is Trian behind the transformation curve?

Ferguson has already radically changed and simplified its business, slashing the number of operating units from 45 to 15 over the past 10 years as well as selling off European operations and restructured the UK business.

Returns on capital have almost doubled from 12.5% to 22.7% over the past decade, according to company data, while the balance sheet has been completely restructured.

Net debt to earnings before interest, tax, depreciation and amortisation (EBITDA) has fallen from 2.7-times to 0.6-times.

FURTHER SHAKE-UP

The company highlighted in half year results update in January that it plans to move its tax domicile from Switzerland to the UK, which requires shareholder approval. Some analysts see this as a possible precursor to an eventual sale of the UK business, although it could simply be to take advantage of more attractive tax rules in the UK.

It is not inconceivable that Peltz hopes to prompt Ferguson management to switch its listing from the UK to the US, by far its biggest market these days.

Last year the company generated approximately 85% of its revenues from the US, and 90% of operating profit. It also has a far larger workforce across the pond, where it employs around 26,500 staff versus the 5,600 people working in the here under the former Wolseley brand.

Maybe Peltz thinks that the business trades at a discount to US peers because UK investors don’t appreciate its quality, potentially leading to a higher share price rating, although this is pure supposition at this stage.

SOFTENING US BACKDROP

What is clear is that US markets seem to be weakening. Just days ago (10 June) Ferguson reported disappointing third quarter results largely thanks to a slowing US backcloth. According to the US Census Bureau, which measures building activity, new housing starts and residential construction put-in-place fell during the first quarter.

On top of this, commercial construction got off to a slow start with ‘very modest growth’.

Canaccord analysts suggested that forecasts may have to edge lower given the slowing demand experienced in the first few months of the year.

At this stage Peltz is keeping details of his intentions under wraps.