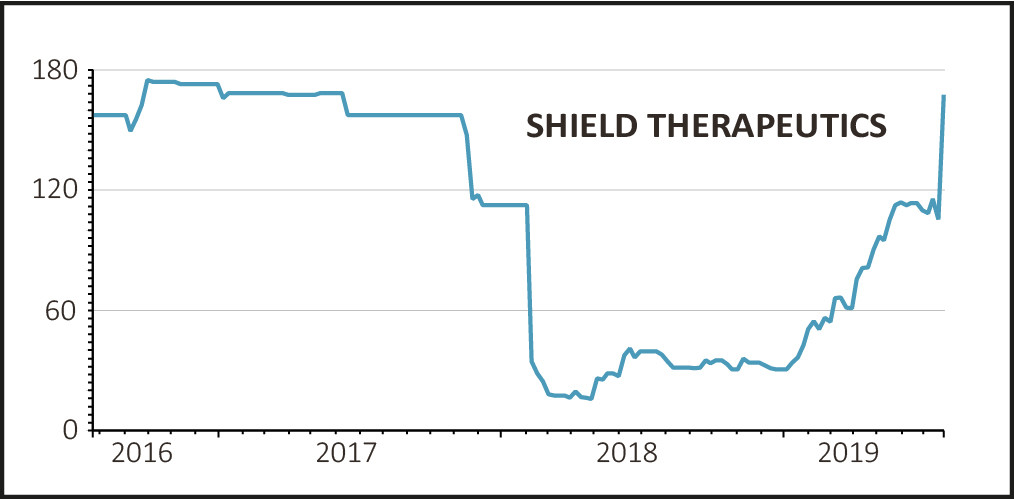

Speciality pharmaceutical company Shield Therapeutics (STX:AIM), announced that the US Food and Drug Administration (FDA) had approved its main product aimed at treating iron deficiency in adults with a broader than expected label, boosting the shares by 60% to 165p.

The US is the largest and most attractively reimbursed pharmaceutical market, with between eight and nine million people who suffer from iron deficiency anaemia and potentially 16m to 27m that require treatment for iron deficiency, according to management. Market research suggests the value of the market to be over $1bn annually.

Chief executive Carl Sterrit said, ‘With this broad approval and IP protection out to 2035, Feraccru®/ Accrufer® has a real and very attractive long-term market opportunity to exploit in the US.’

The FDA has approved the use of Accrufer for as long as necessary to restore patients' iron levels which according to analysts could double the addressable market for the drug.

READ MORE ABOUT SHIELD THERAPEUTICS HERE

Iron deficiency anaemia is a condition where the blood lacks adequate healthy red blood cells, which carry oxygen around the body. As a result sufferers often report that they are tired and short of breath.

The exciting thing about Accrufer is that the body only absorbs as much iron as it needs, which means that the product is ideal for patients who cannot tolerate salt-based iron alternatives.

It also might remove the need for patients to progress to intravenous iron therapy, an expensive treatment, leading to a step change in the way that iron deficiency is treated.

The product will be marketed as Accrufer in the US. The company is in discussions with a number of commercial partners to extract maximum value for shareholders, and will update the market in due course.

The drug is already approved in the European Union and Switzerland for the treatment of iron deficiency in adults and commercialisation is progressing well according to the company.

Broker Peel Hunt has increased its target price to 200p, but says its new target reflects 'exceedingly conservative assumptions' and that there could be several orders of magnitude potential upside to its assumptions.