A lack of oil exploration drilling in the Falklands until late next year could keep investors away from the listed contingent with exposure to the region, according to research house Edison.

This includes: Argos Resources (ARG:AIM); Borders & Southern Petroleum (BOR:AIM); Desire Petroleum (DES:AIM); Falkland Oil & Gas (FOGL:AIM); and Rockhopper Exploration (RKH:AIM).

The fortunes of their larger peer Premier Oil (PMO), which farmed in to Rockhopper's Sea Lion oil discovery last year, are not as tied to this story given the size and breadth of its wider operations.

Edison's review of the Falklands operators, produced by analysts Elaine Reynolds and Ian McLelland, notes the focus in 2013 is likely to be on farm-out deals for Borders and Desire, with results from 3D seismic being shot by Falkland Oil & Gas a further potential catalyst.

'Success for Borders now hangs on its ability to secure a farm-out on favourable terms; however, if this can be secured, we believe it is most likely to provide a material share price catalyst for investors in the near term.'

Borders needs a partner to help fund a planned $280 million to $400 million drilling programme, with a targeted start date of late 2014. At the turn of the year it had $56 million of cash in the bank.

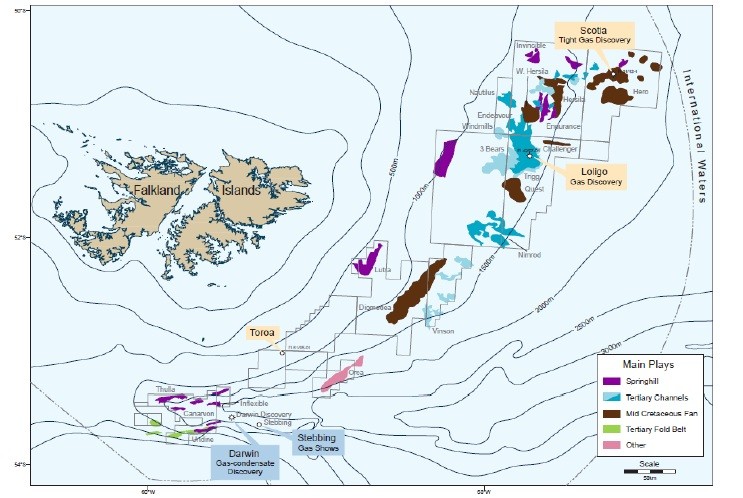

Work off the disputed South Atlantic islands is split between the northern and southern basins. Although a four-well 2012 drilling campaign in the south, split evenly between Falklands Oil & Gas and Borders, failed to repeat Rockhopper's trick in the north and find oil, it did nonetheless uncover a number of natural gas finds. Edison believes oil may still be discovered in the southern basin noting analysis of last year's drilling suggests 'there is likely to be oil, gas and gas/condensate prospects across the basin.'