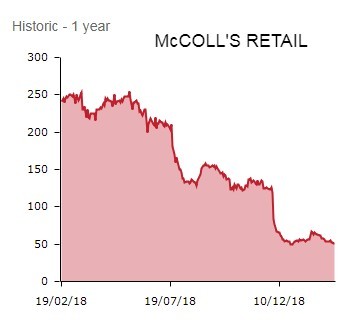

Convenience stores-to-newsagents operator McColl’s Retail (MCLS) rallies 12.7% to 57p on the news the start of full year 2019 has seen an improving like-for-like sales trend. The neighbourhood retailer also avoids another punishing profit warning, still expecting to deliver ‘a modest improvement’ in adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) this year.

Yet McColl’s concedes the grocery sector will remain fiercely competitive in the coming months and analysts still need convincing that the damaging downgrades cycle has come to an end.

UNPRECEDENTED DISRUPTION

Brentwood-headquartered McColl’s has been out of favour following profit warnings driven by ‘unprecedented’ supply chain disruption caused by the failure of Palmer & Harvey (P&H) and the ensuing operational challenges in accelerating the transition to Morrisons (MRW) as the group’s sole supplier.

Moving to a new wholesale supply partner at a much faster pace than anticipated created challenges and disrupted McColl’s plans for the launch of the Safeway brand.

Results for the year ended 25 November reflect said supply chain disruption, very tough trading conditions, cost headwinds including wage inflation and a higher interest bill, showing a slump in pre-tax profit from £18.4m to £7.9m on total like-for-like sales down 1.4%.

As the groceries, alcohol and tobacco purveyor is still recovering from a dire period, management has prudently cut the total dividend from 10.3p to 4p.

MILLER’S TALE

The good news is like-for-like sales showed a (modestly) improving trend through the year. Fourth quarter like-for-like sales were flat and investors are encouraged by early trading in full year 2019. Total like-for-like sales ticked up 1.2% for the 11 weeks ended 10 February, the pick-up reflecting recovery from supply chain disruption as well as a soft prior year comparator.

Despite last year’s disruption, CEO Jonathan Miller explains:

‘We continued to make progress against a number of our key strategic plans. We completed the rollout of 1,300 stores to Morrisons supply in less than nine months, which represents a considerable achievement and provides us with a more secure supply chain and a higher quality chilled and fresh offer. We also continued to invest in our estate, with 59 convenience store refreshes completed in the year and 11 new stores acquired.

‘We are a profitable and cash generative business, and our priority for the year ahead is to rebuild operational momentum and we remain confident in delivering our strategic plans.'

Yet Miller also strikes a cautious tone. ‘Over the coming months the grocery sector will remain intensely competitive as we experience ongoing political and economic uncertainty making consumers cautious about spending. We will need to ensure that we manage cost pressures and maintain competitive retail pricing,’ he warns.

‘One should take a positive out of the recent trading improvement which sees like-for-like sales up 1.2% in the first 11 weeks of full year 2019 and at this early stage full year 2019 guidance remains unchanged,’ notes broker Liberum Capital.

‘However, we have amended our forecasts to reflect higher depreciation and amortisation and interest going forward, resulting in a 23% cut to estimated full year 2019 earnings per share.’ The brokerage remains lukewarm on the stock with a ‘hold’ rating, ‘noting some positives beginning to show, but full year 2019 needs to be a year of stabilisation to give us confidence the downgrade cycle may have troughed.'

Meanwhile Russ Mould, investment director at AJ Bell, comments:

‘The convenience store operator will be glad that its 2018 results are finally published as it will allow the business to move on from what was a terrible year. Supply chain disruption caused major problems and led to a large decline in profit. McColl’s looks to be doing the right thing. Its net debt is coming down rapidly, it is investing in its business to keep stores looking fresh, and it is getting rid of underperforming outlets.

‘Furthermore, it is boosting the number of stores offering hot food and coffee and has added Subway counters to 23 sites.

‘Unfortunately many of its rivals are also strengthening their proposition, meaning that 2019 is not going to be a breeze for McColl’s. It needs to accelerate a shift into higher margin products to give its earnings some sort of cushion if new problems emerge. At the moment its operating profit margins are wafer-thin, leaving no room for error.'