Chemicals business Elementis (ELM) saw profits and earnings slump in 2016. The strong dollar and low oil prices have combined to put the squeeze to its two largest divisions; Speciality Products and Chromium.

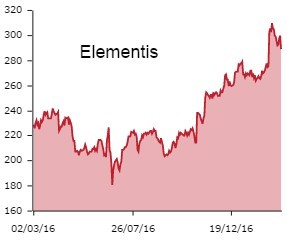

Investors have also been mildly spooked by management talk of uncertainty over the economic environment, although that sort of tone has become de rigueur for many UK-based international companies. That the shares have slipped a litle more than 3% to 289.9p today may be on disappointment over flat ordinary dividends.

An unchanged final payout of $0.575 means the overall dividend of $0.0845 for the year to 31 December 2016 is also flat year-on-year. But there is a modest increase in the special $0.0835 dividend, up from the previous year's $0.08 level.

The Chromium division, which uses the chemical as a protective coating for car parts among other things, saw a significant impact on its operating performance from the strong dollar, with volumes and margins impacted. Operating profit fell 22% to $94.2m.

Analysts believe investors should look beyond today's figures. ‘Despite ongoing weakness in Energy and Chromium, there are a number of bright spots that suggest the current year will indeed deliver a return to organic growth,' says James Tetley, analyst at broker N+1 Singer.

He expects the acquisition of antiperspirant ingredients supplier SummitReheis to be beneficial as personal care is expected to be one of the main growth drivers in the future. Last month, Shares wrote an upbeat assessment of the deal, alongside flagging the likely special dividend.

Adjusted pre-tax profit is anticipated to jump from $89.7m in 2016 to $105.8m this year, according to Tetley. The analyst then sees further increases to $120.5m in 2018, although the implied current year price to earnings (PE) multiple of 19.7-times may not look much of a bargain to many investors.