Point-of-care business EKF Diagnostics (EKF) has beaten previously raised market forecasts for the year to 31 December 2016. In an upbeat trading update the company revealed revenue is expected to exceed £38m, up from ‘at least £36.5m,’ where consensus estimates sat before today.

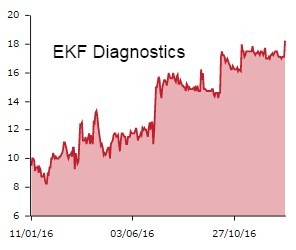

This is more welcome news for the medical diagnostics business and has sparked a 7.6% jump in the share price to 18.4p. That's not surprising given the strength of trading through 2016 that saw forecasts upgraded twice.

Importantly, it is also a clear sign that past problems are firmly behind it. Those chiefly involve the acquisition of Selah Genomics in 2014 in a $70.6m deal, a price that has come to look over-cooked.

Selah’s product sales have since run at an approximate unit rate of half the $941 initially anticipated, leading EKF to warn on profit and sparked a strategic rethink.

Broker N+1 Singer Chris Glasper sees the strong momentum continuing and upgrades his forecasts for the next three years by 3% to 5% at the EBITDA level.

EKF says its earnings before interest, tax, depreciation and amortisation (EBITDA) is expected to rise to over £5.5m due to strong organic growth.

The company expects to remain cash position in the first financial quarter of 2017 and has reduced its debt by £1.6m.

Broker Panmure Gordon & Co analyst Julie Simmonds is encouraged by strong sales across various product ranges, reiterating ‘buy’ and increasing full year 2017 revenue by 7%.