Naysayers speculating problems within the Domino's Pizza (DOM) camp, following the shock resignation of both the chief executive officer and finance director since the summer, have been proved wrong. The fourth quarter trading update shows the core UK business trading in top form with full-year profit to beat market expectations. The moot point is worse-than-expected losses in Germany, meaning that overall group results for 2013 will simply meet market consensus.

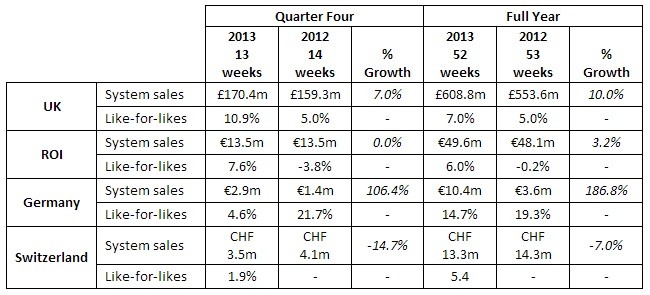

The market is pleased nonetheless as the share price rises 1.3% to 509.5p. The fourth quarter has been particularly good with a 10.9% rise in like-for-like sales in the UK; and 7.6% gain in Ireland. Domino's attributes the gains to increased digital marketing activity and 'more favourable timing of the Christmas break compared to last year.' (Click on the following table to enlarge).

The expansion into Germany is proving more problematic than first expected, yet this is not 'news' to the market. Domino's has flagged the roll-out issues throughout 2013. As we discussed in a recent article, a new CEO - the search is underway - will need to give look closely at the overseas expansion programme as part of a business review.

Sanlam Securities analyst Amisha Chohan reckons the pizza group should continue to see strong like-for-like sales in its core business, driving by the shift online and an improving UK economy.

It is very interesting to see the surge in mobile sales, up 91% in 2013 and accounting for just under a third of all online sales at £29 million. We would imagine this figure dramatically increases again in 2014 given consumer trends in mobile commerce.

Shares in Domino's have nearly recovered all the lost ground since the massive sell-off following news on 6 December that CEO Lance Batchelor was leaving the group. We said in this article to take advantage of the share price weakness and buy at 463.6p. The stock has subsequently risen by 10%.

N+1 Singer analyst Sahill Shan highlights that UK expansion plans in 2013 were scaled back from previous expectations of 55 stores to 50 sites. 'Notably, eight of the new additions were non-traditional/lower revenue sites. This undershoot was generally anticipated and raises question marks over future franchisee appetite.' The analysts maintains a 'hold' rating and 480p price target.