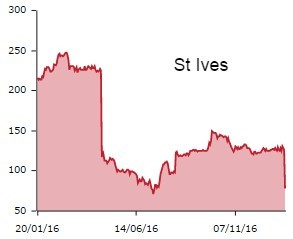

Collapsing growth rates in a key digital marketing division at St Ives (SIV) wiped out a third of the company's market value in one trading session today.

St Ives chief executive Matt Armitage said in a trading statement that growth in its digital and data unit Strategic Marketing was flat in the six months to 27 January.

Organic growth in the division was 9% during St Ives' last financial year and Armitage had pinned the group's hopes on growth in digital marketing via an aggressive campaign of mergers and acquisitions in the sector.

Armitage now says like-for-like growth in the unit will be flat in St Ives' first half with a return to growth not expected until the three months to end-July.

Shares in St Ives crashed by 37.9% to 78.6p on news of the digital marketing slowdown, which is being compounded by more trouble in a unit which offers in-store marketing collateral to the grocery industry.

EARNINGS ESTIMATES SLASHED

Earnings downgrades are large but so are St Ives' share price declines over the past year. The stock now trades on a price-to-earnings ratio of 5.7, according to our calculations, based on revised forecasts by analysts.

St Ives' valuation indicates investors expect there are more profit warnings in the pipeline.

Analyst Johnathan Barratt at investment bank N+1 Singer downgraded his recommendation on the stock from ‘buy’ to ‘hold’ and revised down underlying pre-tax profit estimates from £31.9m to £25m for the year to the end of July.

BRIGHT SPOTS

But there are some bright spots.

While operating margins in St Ives' Marketing Activation unit, which sells into the grocery industry, are under pressure, revenue declines in the same division slowed from 7% last year to 2% in the six months to 27 January 2017.

And chief executive Matt Armitage is pushing through cost cutting measures which will start to bite in the final quarter of St Ives' financial year.

PUBLISHING UNIT SHINES

And in an ironic ironic twist, it is St Ives' Books division which is the company's star performer. St Ives used the cash flow of its Clays black-and-white publishing business to fund acquisitions of digital marketing businesses.

But performance in the old media unit is leaving its new digital stablemates in the shade.

New JK Rowling titles launched by major customer Penguin-Random House have boosted Clays' revenue by 13% over the same period last year.